Expedia (EXPE) shares jumped over 6% during the extended trading session yesterday after the American online travel company delivered blowout second-quarter results. Markedly, the company reported the highest ever second quarter revenues and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA).

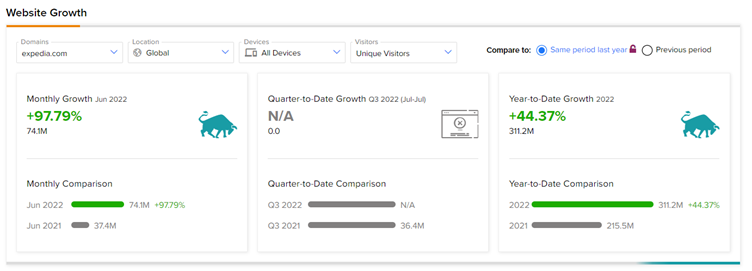

Meanwhile, according to the Tipranks Website Traffic tool, the web visits to expedia.com were up 97.79% year-over-year in June 2022. Moreover, traffic grew by 44.37% in the first six months of this year. The spike in website visits indicated that Expedia could benefit from a rebound in demand.

Learn how Website Traffic can help you research your favorite stocks.

Expedia Q2 Beat

Adjusted earnings of $1.96 per share massively beat analysts’ expectations of $1.56 per share. Further, it was far superior to the reported loss of $1.13 per share for the prior-year period.

Revenues jumped a whopping 51% year-over-year to $3.18 billion and exceeded consensus estimates of $3 billion. The top-line benefited from growth across the Retail, B2B, and trivago segments.

Expedia CEO’s Comments

Expedia Group CEO, Peter Kern, commented, “We continue to focus our energy on improving our technology for our travelers and partners and attracting more valuable customers through direct relationships. These actions, along with prior actions to drive efficiency, put us in a better position to withstand any further macroeconomic headwinds should they arise.”

Wall Street’s Take on Expedia

Following Q2 results, Barclays analyst Deepak Mathivana increased the price target on Expedia to $161 (57.53% upside potential) from $157 and reiterated a Buy rating.

The rest of the Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on eight Buys and 10 Holds. The average Expedia price target of $143.06 implies a 39.98% upside potential to current levels.

Concluding Thoughts

Driven by robust travel demand, it is commendable that Expedia reported outstanding Q2 beat despite a tough macroeconomic backdrop.

Though inflationary pressures could curb consumer spending and may impact travel bookings, record high bookings during the quarter shows consumers are unwilling to cut back on their travel plans.