Shares of Whitecap Resources (WCP) rose 4% in early trading Monday after the company announced it had completed its acquisition of Kicking Horse Oil & Gas Ltd., a privately-held subsidiary of Quantum Energy Partners. Whitecap is a publicly-held oil company based in Calgary, Alberta.

Whitecap Resources acquired Kicking Horse for C$56 million in cash and 34.5 million common shares of Whitecap Resources while assuming Kicking Horse’s net debt.

The company also provided an update on Montney resource play. The company said that due to the exceptional results from the Montney wells, the outperformance of its existing assets, and raw material prices above its forecast of $60/bbl WTI, the company expects to generate significant free funds flow in 2021 and beyond.

Therefore, the board of directors has approved an 8% increase in its monthly dividend, from C$0.01508 to C$0.01625 per common share, translating into an annual dividend of C$0.195 per common share. (See Whitecap Resources stock analysis on TipRanks)

Whitecap Resources published its first ESG newsletter today on its website and expects to release its 2021 Environmental, Social, and Governance (ESG) report in mid-June 2021, which will also include 2020 results.

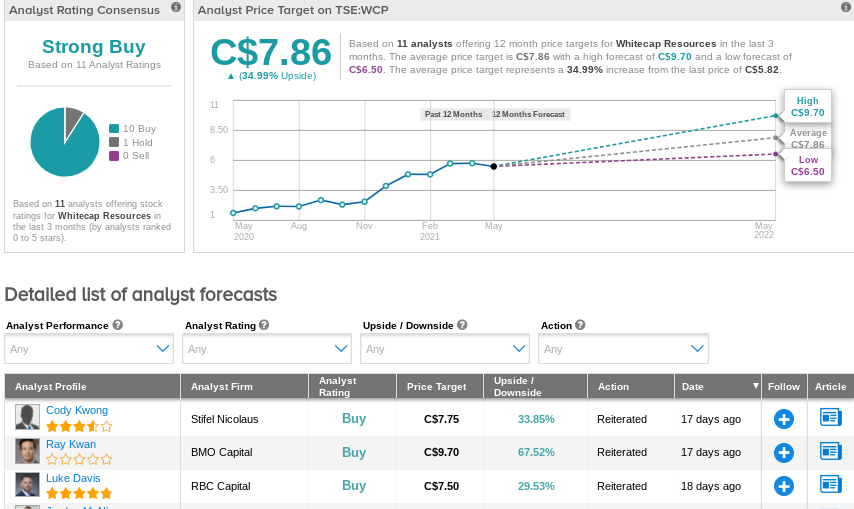

On April 30, Stifel Nicolaus analyst Cody Kwong reiterated a Buy rating on WCP while raising its price target to C$7.75 (from C$7.50) for 34% upside potential.

Overall, WCP stock scores a Strong Buy consensus rating based on 10 Buys and 1 Hold. The average analyst price target of C$7.86 implies 35% upside potential to current levels. Shares have risen approximately 20% year-to-date.

Related News:

SNC-Lavalin Swings to a Q1 Profit; Shares Pop 15%

Boyd Group Services 1Q Profit Falls 55%; Shares Drop 6%

Crescent Point Energy Swings To A 1Q Profit On Higher Oil Prices; Shares Pop 4%