Tesla (NASDAQ:TSLA) shares are down nearly 3% in early trading today after a Delaware judge voided CEO Elon Musk’s $56 billion compensation package. That’s more money than most humans will ever earn in their lifetimes. Citing Musk’s close ties with the electric vehicle maker’s directors who were deciding on the compensation, the judge deemed the process of approving the package “Deeply flawed,” according to the Wall Street Journal. Mr. Musk does not draw any salary from Tesla, and a substantial chunk of his assets comes from his ownership of the company.

Now, Tesla may have to chalk up a new compensation plan for Musk, a serial entrepreneur with his fingers in multiple pies ranging from AI, autonomous robots, flamethrowers, satellites, spacecraft, tunnels, social media, and most recently, implanting chips into humans.

In the run-up to the court verdict, Musk had also been pushing for more control at Tesla. The CEO noted his discomfort with leading Tesla’s charge into AI and robotics without controlling at least 25% of the company. He already owns a 13% stake in Tesla.

After the court struck down the biggest compensation package ever for a CEO of a public company in the U.S., Mr. Musk tweeted, “Never incorporate your company in the state of Delaware.” For now, he has launched a poll on X if Tesla should change its state of incorporation to Texas. Nearly nine-tenths of the respondents seemed to be in favor of the move at the last check.

Still, Musk has delivered a rare and laudable feat, driving Tesla’s valuation from around $50 billion when the $56 billion package was negotiated to over a trillion dollars at one point in time. However, a key risk for Tesla investors remains constant today, as it did over six years ago: the company’s ability to retain its Key Man.

Is Tesla Stock Expected to Go Up?

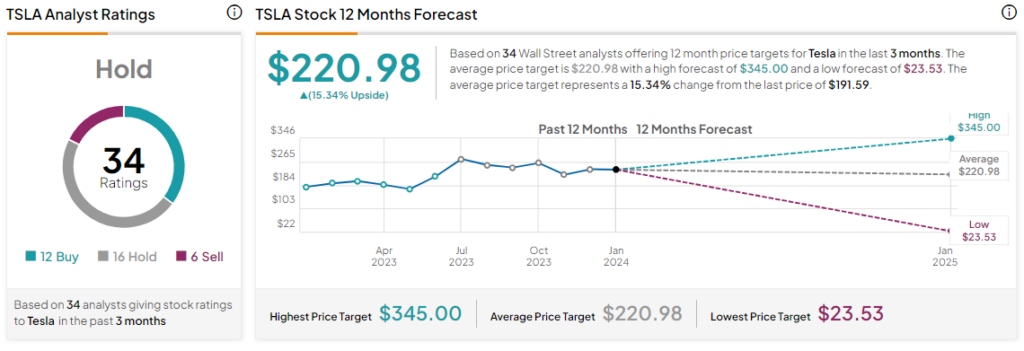

Shares of the company have dropped by nearly 23% so far this month, and its recent fourth-quarter numbers did not exactly enthuse investors. Overall, the Street has a Hold consensus rating on Tesla, and the average TSLA price target of $220.98 points to a 15.3% potential upside in the stock.

Read full Disclosure