Tesla (TSLA) CEO Elon Musk agreed to purchase social media company Twitter (TWTR) for $44 billion. A number of recent events are fueling speculation that Musk might be seeking to ditch the buyout deal. Both Tesla and Twitter stocks have dropped after Musk agreed to acquire the social media company.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

According to a Reuters report, Musk is prone to changing his mind. A few years ago, Musk said he would build a peanut brittle company to challenge See’s Candies, according to the report. Warren Buffett’s Berkshire Hathaway owns See’s Candies. Musk never followed through with that plan. Perhaps Musk’s refusal to join Twitter’s board after earlier appearing to agree to be part of it is another example of the electric vehicle (EV) manufacturer changing his mind.

Why Might Musk Want to Abandon Twitter Buyout?

In the case of Twitter, Reuters reports that China could cause Musk to rethink the deal. Twitter is not welcomed in China, yet China is an important market and manufacturing hub for Tesla. Much of Musk’s wealth is tied to his stake in the electric carmaker. If Musk is concerned that Twitter’s ownership could complicate things for Tesla in China, then he may seek to abandon the deal.

Another reason Musk may get cold feet about the Twitter buyout agreement is its impact on Tesla stock. The decline in Tesla stock following the Twitter takeover deal has been attributed to investors worrying that Musk would sell large amounts of Tesla shares to fund the acquisition. Others fear that Musk’s adding Twitter to his roster of companies could distract him from Tesla.

What Happens If Musk Abandons Twitter Deal?

As part of the Twitter buyout agreement, Musk is required to not disparage the company or its employees. However, the billionaire has recently published tweets criticizing the company’s actions, even singling out its top lawyer, Vijaya Gadde, in moves that potentially breach the agreement.

If Musk backs out of the Twitter buyout deal, he would be required to pay $1 billion in a breakup fee to the company. If it walks out of the agreement, Twitter would also be on the hook for a similar bill.

Wall Street’s Take

The stock has a Hold consensus rating based on three Buys, 25 Holds, and one Sell. The average Twitter price target of $34 implies 6.3% downside potential from current levels.

News Sentiment

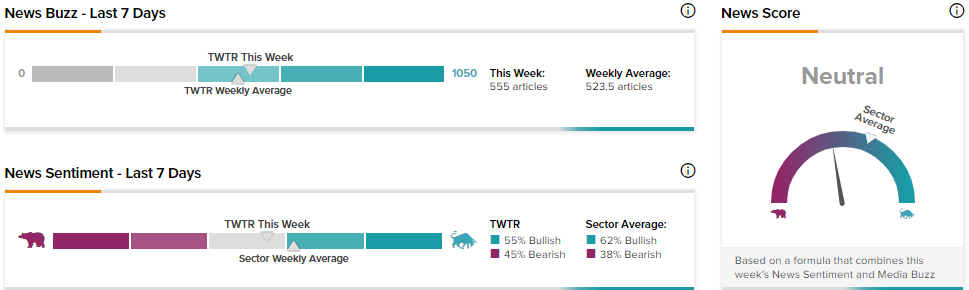

TipRanks data shows that the News Score for Twitter is currently Neutral based on 555 articles published over the past seven days. Notably, 55% of the articles have a Bullish Sentiment compared to a sector average of 62%, while 45% of the articles have a Bearish Sentiment compared to a sector average of 38%.

Key Takeaway for Investors

There may be little for Musk and Twitter shareholders to lose if the takeover deal fails. For Musk, if the deal threatens to trigger fallout at Tesla, then paying the $1 billion termination fee would be both an affordable and worthwhile sacrifice to make. For Tesla shareholders, the company’s prospects look promising as more advertising dollars continue to shift online and the company explores subscription revenue opportunities.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Despite Bottlenecks, Ford Posts Quarterly Beat

PayPal Shares Gain Despite Lowering FY22 Guidance

Why Does Lower Revenue Bother Meta, Despite Earnings Beat?