Tyler Technologies (TYL) provides public sector software to customers, including local, state, and federal government agencies. It recently acquired NIC to expand its business, but that transaction led it to take on some debt.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

“The integration of NIC, as well as ReadySub and DataSpec, is well underway, and we are pleased with our momentum…We remain on track with our strategic initiatives, including our investments in cloud optimization,” commented Tyler CEO Lynn Moore.

Let’s take a look at Tyler’s latest financial performance and risk factors.

Tyler’s Q2 Financial Results and 2021 Outlook

The company reported second-quarter adjusted revenue of $405.4 million, representing an increase of 49.4% year-over-year and exceeding consensus estimates of $376.1 million. Adjusted EPS came to $1.83, rising from $1.38 a year ago and topping consensus estimates of $1.63. (See Tyler stock charts on TipRanks).

For full-year 2021, Tyler estimates adjusted revenue in the band of $1.54 billion – $1.56 billion. Adjusted EPS is expected to be in the range of $6.70 – $6.80.

Tyler spent $2.3 billion on the NIC acquisition and entered into several debt agreements in connection with the acquisition. It offered notes maturing in 2026 to raise $600 million, and obtained a $1.4 billion credit facility comprising $900 million of three- and five-year loans, and an additional $500 million revolving credit facility.

Tyler’s Risk Factors

According to the new TipRanks Risk Factors tool, 31 risk factors have been identified for Tyler. Since June 2021, the company has amended its risk profile to introduce five new risk factors, all under the Finance and Corporate category.

All of the newly added risk factors relate to the challenges of servicing its debt. For example, Tyler says its cash flow from operations may not be sufficient to pay its debts, which could adversely impact its business.

Also, Tyler tells investors it obtained some of its borrowings at variable rates. It cautions that if interest rates increase, the cost of servicing the debt would rise. Furthermore, Tyler cautions investors of potential stock dilution risk related to the issuance of convertible notes.

Finance and Corporate is Tyler’s top risk category, accounting for 42% of the total risks. Tech and Innovation and the Ability to Sell are the next two major risk categories at 26% and 16%, respectively.

Tyler’s Finance and Corporate risk factor is above the sector average at 42% versus 38%. The company’s shares have gained about 12% since the beginning of 2021.

Analysts’ Take

Following Tyler’s Q2 report, Benchmark Co. analyst Mark Schappel reaffirmed a Buy rating on Tyler stock and raised the price target to $540 from $490. Schappel’s new price target suggests 10.61% upside potential. The analyst believes investors should take advantage of the pullback in Tyler stock to build positions.

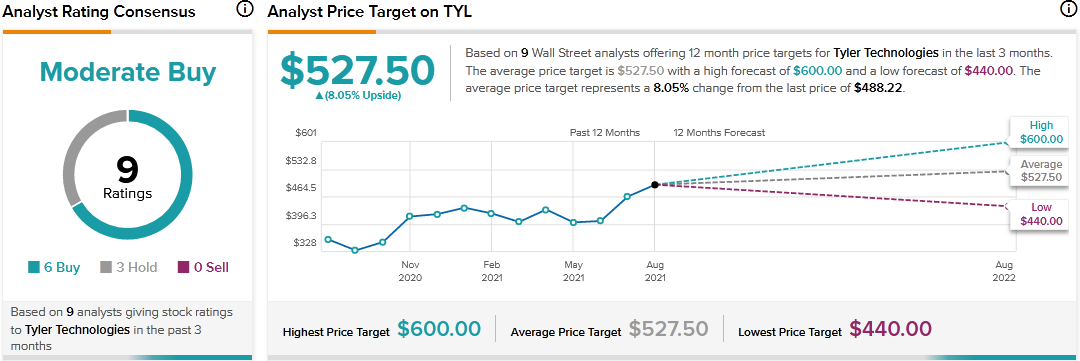

Consensus among analysts is a Moderate Buy based on 6 Buys and 3 Holds. The average Tyler price target of $527.50 implies 8.05% upside potential to current levels.

Related News:

What Does Lumen’s Newly Added Risk Factor Tell Investors?

DraftKings’ Q2 Revenue Tops Estimates

What Do Booking’s Newly Added Risk Factors Reveal?