Twitter (TWTR) reported Q2 2022 results that both declined from the same quarter last year and missed the consensus estimate. Apart from advertising industry headwinds, the social media company also blamed the uncertainty related to the Elon Musk deal for its weak performance. Musk has sought to terminate his deal to acquire Twitter for $44 billion, and the dispute is now in court.

Earnings Numbers at a Glance

Revenue slipped 1% year-over-year to $1.18 billion and missed the consensus estimate of $1.32 billion. Advertising contributes the bulk of Twitter’s revenue. Advertising sales increased 2% year-over-year to $1.08 billion. Subscription and other revenue decreased 27% year-over-year to $101 million.

Adjusted loss per share came in at $0.08 compared to adjusted profit per share of $0.20. It also missed the consensus estimate of $0.14 profit per share. Apart from the decline in revenue, a sharp increase in costs also weighed on the bottom line. Total costs and expenses jumped 31% year-over-year to $1.52 billion.

Twitter ended the quarter with 237.8 million monetizable daily active users, up 16.6% year-over-year. It attributed the increase to product improvements and global talks about current events. Despite the increase, Twitter’s user metric still fell short of the consensus estimate of 238.08 million.

Pending Musk Deal Costs Twitter $33 Million

Twitter incurred $33 million in costs related to its pending buyout deal with Musk. The company incurred an additional $19 million in severance-related costs after it recently laid off some of its employees. Apart from the disagreement over fake Twitter accounts, Musk has also cited job cuts as another reason for seeking to exit from the Twitter buyout deal. His complaint is that Twitter cut the jobs without his consent, potentially violating the terms of their deal.

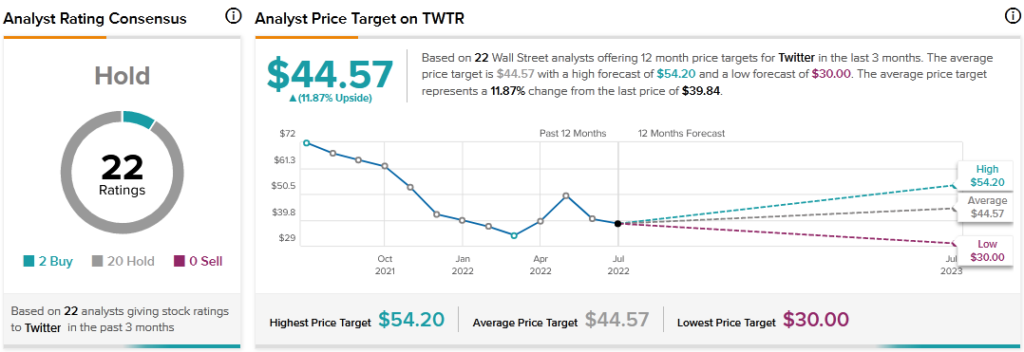

Wall Street Recommends Hold on TWTR Stock

On July 22, Evercore ISI analyst Mark Mahaney reiterated a Hold rating on Twitter stock with a price target of $54.20, which indicates 36% upside potential.

The stock has a Hold consensus rating based on two Buys and 20 Holds. The average Twitter price target of $44.57 implies 12% upside potential to current levels.

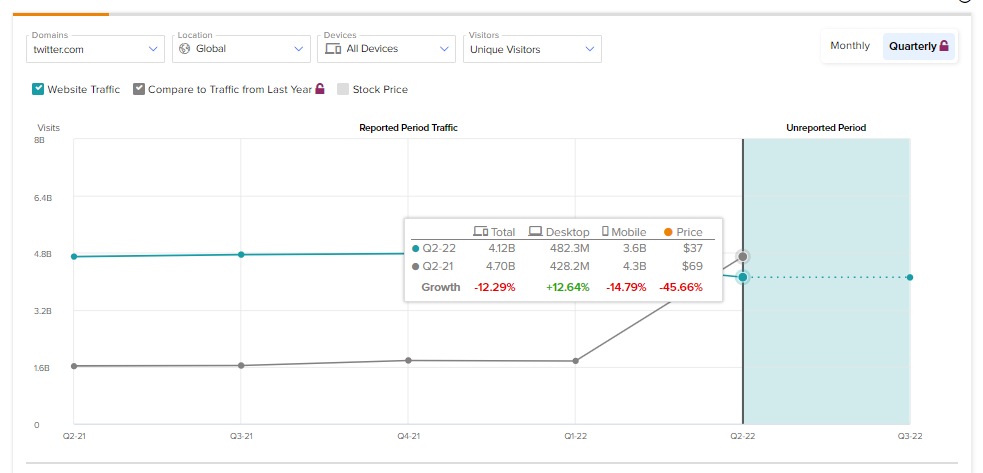

Website Traffic Tool Predicted Twitter’s Revenue Decline

During Q2, Twitter’s Website Traffic Tool recorded a 12% year-over-year drop in total visits. Website traffic trends can help investors gauge customer interest in a company’s products or services, which can in turn help in assessing the company’s likely performance.

In Twitter’s case, the traffic drop correctly predicted the company’s Q2 revenue decline. Learn how Website Traffic can help you research your favorite stocks.

Key Takeaway for Investors

Twitter is heavily reliant on advertising, but the industry is highly competitive. While the company’s attempt to diversify from advertising is appreciated, those efforts appear to be struggling, as shown by the sharp decrease in subscription and other revenue in the latest quarter.

Read full Disclosure