Seattle-headquartered Seagen (SGEN) develops drugs for treating cancer. The global biotechnology company has several drugs in the market and awaits an FDA decision on another drug candidate, which could expand its product portfolio.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Let’s take a look at Seagen’s latest financial performance and risk factors.

Seagen’s Q2 Financial Results and 2021 Guidance

Revenue increased to $388.5 million from $278 million a year ago and exceeded the consensus estimate of $355.03 million.

Seagen attributed the revenue growth primarily to the higher sales of PADCEV and the addition of TUKYSA to its portfolio. Its other drug on the market, ADCETRIS, contributed the bulk of product revenue in Q2 and recorded a 9% increase in sales from a year ago. Notably, a whopping 427% increase in TUKYSA sales and a 44% increase in PADCEV sales were recorded.

Seagen CEO Clay Siegall commented, “The commercial execution across our three brands continues to be strong, achieving record quarterly net product sales for each of ADCETRIS, PADCEV and TUKYSA…Looking ahead to the remainder of 2021, Seagen is poised to add a fourth product, tisotumab vedotin, which has an FDA action date in October 2021.” (See Seagen stock charts on TipRanks).

The company reported a loss per share of $0.47 in Q2, which widened from the loss of $0.12 per share a year ago, but still beat the consensus estimate of a loss per share of $0.60. Markedly, Seagen closed the quarter with $2.5 billion in cash and investments.

For the full-year 2021, Seagen anticipates combined revenues from the sale of its ADCETRIS, PADCEV, and TUKYSA drugs of between $1.29 billion and $1.34 billion, with Royalty revenue in the $125 million to $135 million range.

Seagen’s Risk Factors

The new TipRanks Risk Factors tool shows 43 risk factors for Seagen. Since June 2021, the company has amended its risk profile to add one new risk factor under the Legal and Regulatory category.

In the newly added risk factor, Seagen cautions investors that it may have to contend with lower prices for its drugs and could experience increasing costs following healthcare law and policy changes.

Finance and Corporate and Legal and Regulatory are Seagen’s top risk categories, accounting for 28% of total risks each. Tech and Innovation is the next major risk category at 16%.

Seagen’s Finance and Corporate risk factor is below the sector average at 28% versus 30%. But its Legal and Regulatory risk factor is above the sector average at 28% versus 21%.

Analysts’ Take

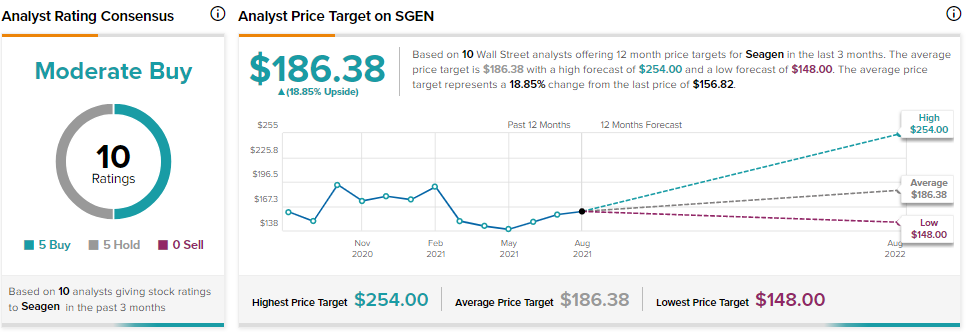

Following Seagen’s Q2 report, Oppenheimer analyst Jay Olson reiterated a Buy rating on Seagen stock and raised the price target to $210 from $208. Olson’s new price target suggests 33.91% upside potential.

Consensus among analysts is a Moderate Buy based on 5 Buys and 5 Holds. The average Seagen price target of $186.38 implies 18.35% upside potential to current levels.

Related News:

BioNTech Q2 Revenues and Earnings Top Estimates; Shares Pop 15%

What Do Qualtrics’ Newly Added Risk Factors Reveal?

What Investors Can Learn from Tyler’s Newly Added Risk Factors