Hillenbrand, Inc. (HI) is an American global diversified industrial company. It runs its businesses under brands such as Batesville, Mold-Masters, Milacron Injection Molding & Extrusion, and Coperion.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Let’s take a look at the company’s latest financial performance and changes to its risk factors. (See Hillenbrand stock charts on TipRanks).

Hillenbrand’s Fiscal Q3 Financial Results and Q4 Outlook

Revenue for the third quarter ended June 30 increased 14% year-over-year to $695 million and exceeded the consensus estimate of $685.99 million. Revenue growth was driven by the molding technology and advanced process solutions businesses as Batesville sales declined. The company posted adjusted EPS of $0.85, compared to $0.81 in the same quarter last year and the consensus estimate of $0.77.

For Q4, Hillenbrand anticipates revenue in the range of $713 million to $738 million. It expects the molding technology and advanced process solutions businesses to continue to lead growth. Meanwhile, it expects sales in the funeral unit Batesville to continue falling. Hillenbrand anticipates adjusted EPS in the band of $0.82 to $0.92 for the quarter. The consensus estimate calls for revenue of $709 million and EPS of $0.87.

Hillenbrand ended Q3 with $477.7 million in cash. The company spent $43.4 million on stock repurchases and paid $16 million in dividends in Q3. It went on to make another $56.6 million in repurchase in July and plans to distribute $0.2150 per share in dividends on September 30.

Hillenbrand’s Risk Factors

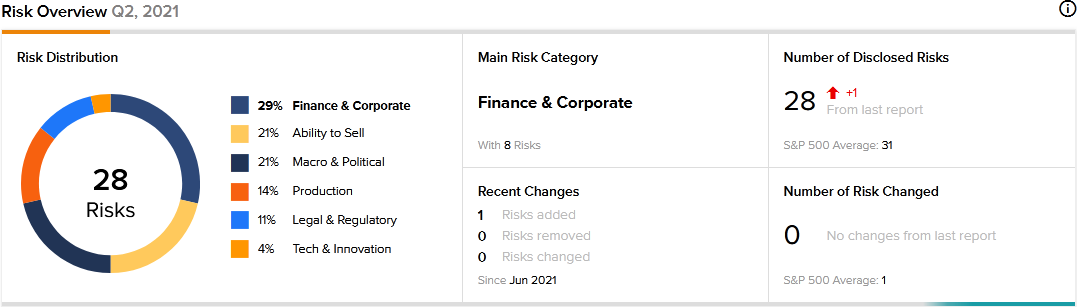

The new TipRanks Risk Factors tool shows 28 risk factors for Hillenbrand. Since Q4 2020, the company has updated its risk profile with one new risk factor.

Hillenbrand tells investors that its stock repurchase program may be terminated at any time. At the end of June 2021, $156.6 million remained under the share repurchase authorization. The program has no end date. Hillenbrand has classified the repurchased shares as treasury stock.

The majority of Hillenbrand’s risk factors fall under the Finance and Corporate category, with 29% of the total risks. That is below the sector average of 39%. Hillenbrand’s stock has gained about 5% since the beginning of 2021.

Analysts’ Take on Hillenbrand

In August, Barrington Research analyst Christopher Howe reiterated a Buy rating on Hillenbrand stock and raised the price target to $62 from $61. Howe’s new price target suggests 48.75% upside potential.

Consensus among analysts is a Moderate Buy based on 1 Buy. The average Hillenbrand price target of $62 implies 48.75% upside potential to current levels.

Related News:

Taking Stock of Evolution Petroleum’s Risk Factors

Ares Management Makes $150M Preferred Equity Investment in Inter Miami CF

Peoples Bancorp Snaps Up Premier Financial Bancorp