WD-40 Company (WDFC) is an American multinational company. It manufactures and sells products that solve problems in homes, workshops, and factories. (See Insiders’ Hot Stocks on TipRanks)

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Let’s take a look at the company’s latest financial performance, corporate updates, and newly added risk factors.

Fiscal Q4 Financial Results

WD-40 Company reported revenue of $115.24 million for its Fiscal 2021 fourth-quarter ended August 31. That increased from $111.65 million in the same quarter last year but missed the consensus estimate of $117.47 million. It posted EPS of $0.61, compared to $1.43 in the same quarter last year, and missed the consensus estimate of $1.23.

For the full year of fiscal 2021, revenue increased 19% to $488.1 million. EPS jumped to $5.09 from $4.40 in the previous year.

WD-40 Company anticipates Fiscal 2022 full-year revenue to be in the range of $522 million to $542 million. It expects EPS for the year to be in the band of $5.24 to $5.38.

Corporate Updates

WD-40 Company ended Q4 with $86 million in cash. It plans to distribute a quarterly dividend of $0.72 per share on October 29.

The company’s board has approved a $75 million stock repurchase program, which will take effect in November 2021 and run through August 2023. The company said the timing and amount of the repurchases will depend on regulations and whether conditions are favorable.

Risk Factors

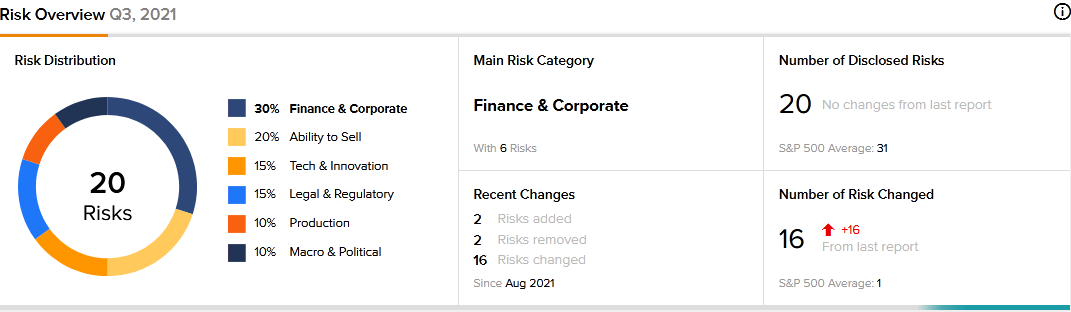

WD-40 Company carries 20 risk factors, according to the new TipRanks Risk Factors tool. Since August 2021, the company has updated its risk profile with two new risk factors under the Finance and Corporate category.

WD-40 Company carried $114.94 million in long-term borrowings at the end of Fiscal Q4. It cautions that it may not have enough cash to service its debts, pay dividends, or fund its stock repurchase program. Therefore, cash concerns may cause the company to suspend dividends and stock repurchases.

WD-40 Company tells investors that it may make acquisitions or enter into joint venture arrangements to drive growth. It cautions that such efforts could drive it into more debt, and there is no guarantee that they would deliver the desired outcomes.

The majority of WD-40 Company’s risk factors fall under the Finance and Corporate category, with 30% of the total risks. That is below the sector average of 43%. WD-40 Company’s stock price has declined about 15% since the beginning of 2021.

Analysts’ Take

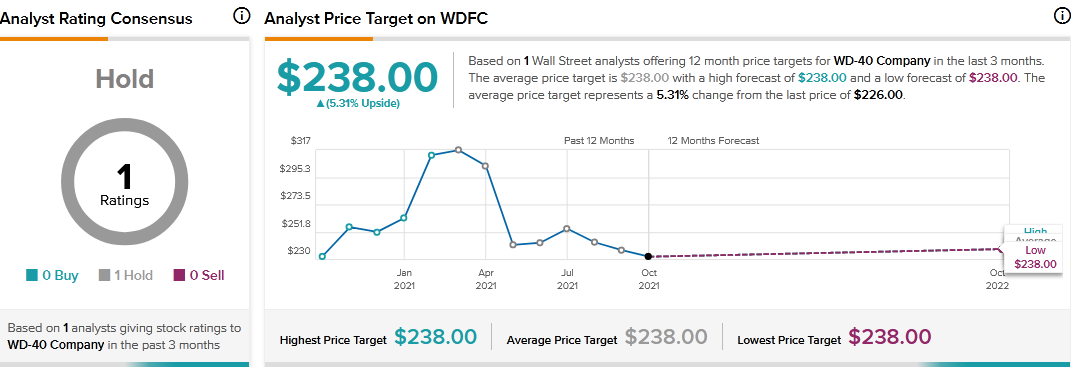

Following WD-40 Company’s Q4 report, D.A. Davidson analyst Linda Bolton Weiser reiterated a Hold rating on WDFC stock but lowered the price target to $238 from $277. Weiser’s new price target suggests 5.31% upside potential.

Related News:

Advanced Micro Devices’ Q3 Results Beat, Q4 Forecasts Top Estimates

Analysts Bullish on Crown Holdings After Strong Q3 Results

CIBC Accepting Applications for Youth Accelerator Program