California-based Upstart Holdings (UPST) operates an artificial intelligence-powered lending platform. The company recently announced a plan to raise $575 million through convertible notes maturing in 2026. It intends to use a portion of the money from the offering for general corporate purposes.

Let’s take a look at Upstart’s latest financial performance and risk factors.

Upstart’s Q2 Financial Results and 2021 Guidance

The company reported second-quarter revenue of $194 million, marking an increase of 1,018% year-over-year and topping consensus estimates of $157.76 million. Net profit of $37.3 million resulted in adjusted EPS of $0.62, beating consensus estimates of $0.25. (See Upstart stock charts on TipRanks)

For Q3, Upstart anticipates revenue in the range of $205 million – $215 million, with net income of between $18 million and $22 million. For full-year 2021, the company raised its revenue guidance to $750 million from $600 million.

Upstart’s Risk Factors

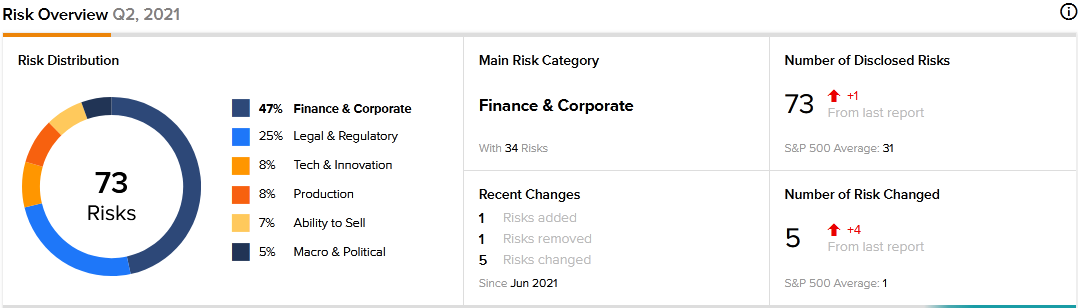

The new TipRanks Risk Factors tool shows 73 risk factors for Upstart. Since December 2020, the company has revised its risk profile to remove one old risk factor and introduce one new risk factor.

The company removed a Finance and Corporate risk about transactions for loan funding. The company had warned investors that if its fundraising arrangements for loan financing were found to violate the law, its ability to raise funds in the future could be hampered. Additionally, the company warned it could be subject to regulatory enforcement actions or private litigation.

Upstart’s newly added risk factor falls under the Production category and relates to the company’s shift to a remote working structure. In June 2021, the company announced a Digital First workforce model where its staff will primarily work remotely and spend less time in the office. Upstart cautions investors that this is a shift with an uncertain outcome. For example, it states that problems such as power outages may affect its staff’s ability to work remotely, and may disrupt its normal operations.

Finance and Corporate is Upstart’s top risk category, accounting for 47% of its total risks. That is above the sector average at 39%. Upstart’s shares have gained about 393% since the beginning of 2021.

Analysts’ Take

Following Upstart’s Q2 report and 2021 guidance raise, Piper Sandler analyst Arvind Ramnani reiterated a Buy rating on UPST stock and raised the price target to $191 from $152. Ramnani’s new price target suggests 4.92% downside potential.

Consensus among analysts is a Strong Buy based on 7 Buys. The average Upstart price target of $189 implies 5.92% downside potential from current levels.

Related News:

Broadridge Financial Solutions’ Earnings and Risk Factors

Keysight Launches 5G Radio Access Network Performance Analytics Solution

Arcimoto’s Q2 Results Miss Estimates; Shares Fall 11.5%

Questions or Comments about the article? Write to editor@tipranks.com