Tenable Holdings (TENB) is a cybersecurity company based in Maryland. It serves governments and corporations. Its customers include more than 30% of the Global 2000 and 50% of the Fortune 500 companies.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Let’s take a look at Tenable’s latest financial performance, corporate updates, and risk factors.

Tenable’s Q2 Financial Results and 2021 Guidance

The company reported a 22% year-over-year increase in revenue to $130.3 million for the second quarter. Adjusted EPS came to $0.09, compared to $0.04 a year ago. Tenable ended Q2 with $261 million in cash. (See Tenable stock charts on TipRanks).

For Q3, the company anticipates revenue in the range of $133 million – $135 million. It sees adjusted EPS for the quarter in the band of $0.01 – $0.03. For full-year 2021, Tenable anticipates revenue of between $528 million – $531 million. It expects adjusted EPS for the year in the range of $0.25 – $0.29.

Tenable’s Corporate Updates

Tenable said it gained 399 new enterprise customers during Q2 and added 67 new six-figure clients. It closed a $425 million new credit facility consisting of a $375 million term loan and a $50 million revolving credit facility.

It completed the acquisition of Alsid and proceeded to launch a new security solution that targets one of the most common attack paths. Further, Tenable entered into a strategic partnership with Deloitte to focus on secure smart manufacturing.

Tenable CEO Amit Yoran commented, “Our recent acquisition of Alsid and the closing of our $425 million credit facility position us well for continued growth and success.”

Tenable’s Risk Factors

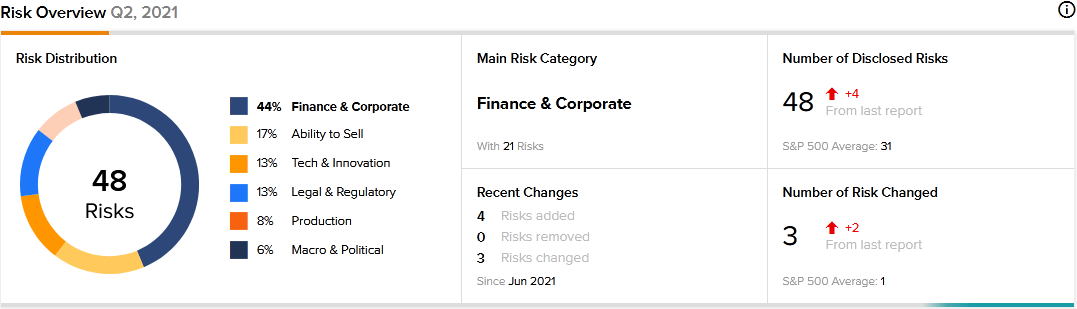

The new TipRanks Risk Factors tool shows 48 risk factors for Tenable. Since December 2020, the company has updated its risk profile to introduce four new risk factors under the Finance and Corporate category.

The company says it has debts to service. It tells investors that if it does not generate sufficient cash flow, it may be unable to meet its debt obligations. As a result, it may have to delay investments, raise additional capital, or restructure the debts. It cautions that it could end up with higher interest rates and restrictions to its operations.

Tenable further tells investors that it has entered into a credit agreement that limits its ability to pay dividends, repurchase shares, or borrow additional funds that it may need for capital expenditures or acquisitions. It also cautions that defaulting on that credit agreement could lead to actions against its collateral assets or cause a default in other credit agreements.

Finance and Corporate is Tenable’s top risk category, accounting for 44% of the total risks. That is above the sector average at 39%. Tenable’s shares have declined about 16% since the beginning of 2021.

Analysts’ Take

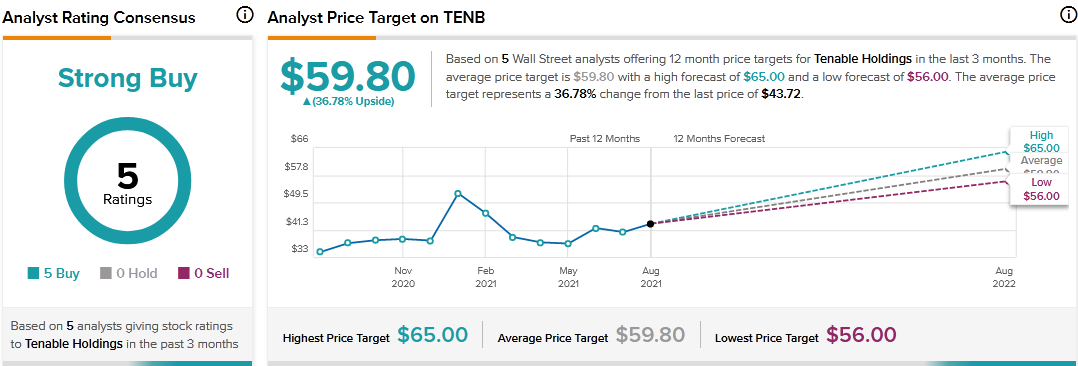

This week, FBN Securities analyst Shebly Seyrafi initiated coverage of Tenable stock with a Buy rating and a $60 price target. Seyrafi’s price target suggests 37.24% upside potential. The analyst observed that Tenable is the leader in the vulnerability management market with significantly more customers than competitors. Seyrafi estimates the vulnerability management market to be worth $6 billion.

Consensus among analysts is a Strong Buy based on 5 Buys. The average Tenable price target of $59.80 implies 36.78% upside potential to current levels.

Related News:

A Look at Schrodinger’s Earnings and Risk Factors

Dick’s Reports Record Q2 Results; Shares Pop 13%

What Does Atea Pharmaceuticals’ Newly Added Risk Factor Tell Investors?