Texas-based Commercial Metals Company (CMC) manufactures steel and metal products. Its business also includes metal recycling.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Let’s take a look at the company’s latest financial performance, corporate updates, and newly added risk factors.

Fiscal Q4 Financial Results

Commercial Metals Company reported revenue of $2.03 billion for its Fiscal 2021 fourth quarter ended August 31. That increased from revenue of $1.41 billion in the same quarter last year but fell slightly short of the consensus estimate of $2.04 billion. The company posted adjusted EPS of $1.26, compared to $1.04 in the same quarter last year, but missed the consensus estimate of $1.27.

Commercial Metals Company plans to distribute a quarterly dividend of $0.14 per share on November 10 to shareholders of record on October 27. The company ended Q4 with $497.7 million in cash. (See Top Smart Score Stocks on TipRanks)

Corporate Updates

Commercial Metals Company’s board has authorized a new share repurchase program of up to $350 million. The company intends to repurchase the shares in the open market or through privately agreed transactions.

Commercial Metals Company plans to sell its Rancho Cucamonga site in California after it ceased operations there. It expects the sale to generate $300 million, which it intends to invest in its new Arizona 2 micro mill. The sale of the California site is expected to be completed in the second quarter of Fiscal 2022.

Risk Factors

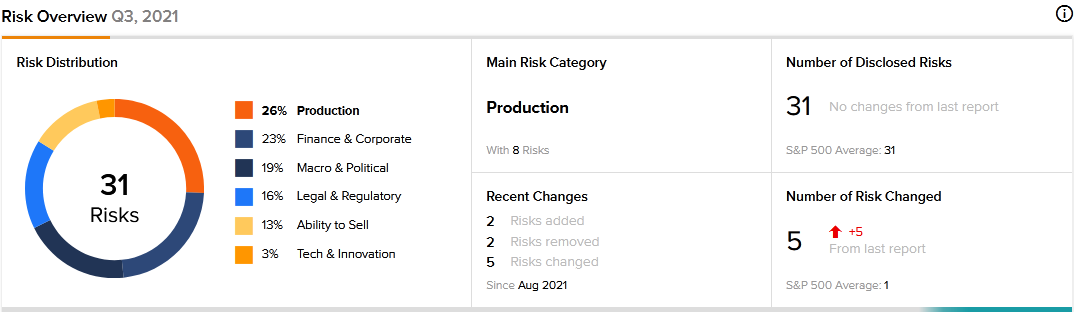

A total of 31 risk factors have been identified for Commercial Metals Company, according to the new TipRanks Risk Factors tool. Since August 2021, the company has updated its risk profile with two new risk factors and removed two old ones.

In a newly added risk factor, Commercial Metals Company tells investors that changes in tax laws may have an unfavorable impact on its operating results and financial condition. It notes that federal, state, and local tax rules tend to change from time to time.

In another new risk factor, Commercial Metals Company cautions that the new micro mill in Arizona may not generate the anticipated benefits. It mentions that cost overruns and process difficulties could result in the loss of the investment made in the project.

The company dropped the risk factor that warned that certain provisions for the 2017 Tax Cut and Jobs Act could adversely affect its business and financial condition. Additionally, the company removed the risk associated with the 2010 Patient Protection and Affordable Care Act, or Obamacare. It had warned that the healthcare legislation could increase its costs and reduce the funds available for capital investments or dividend payments.

The majority of Commercial Metals Company’s risk factors fall under the Production category, with 26% of the total risks. That is above the sector average of 21%. The company’s stock price has increased about 55% year-to-date.

Analysts’ Take

Goldman Sachs analyst Emily Chieng recently upgraded Commercial Metals Company stock rating to a Hold from a Sell and raised the stock’s price target to $33 from $31. Chieng’s new price target suggests 3.94% upside potential. The analyst believes that the company would be a major beneficiary of the infrastructure bill.

Consensus among analysts is a Hold based on 2 Holds. The average Commercial Metals Company price target of $34.50 implies 8.66% upside potential to current levels.

Related News:

PLBY Group to Acquire Dream for $30M; Street Says Buy

Verizon to Provide Private Mobile Edge Computing for Enterprises

Accenture Highlights New Risk Factors Amid Acquisitions