Booking Holdings (BKNG) provides online travel services across more than 220 countries, with its brands including Priceline, Booking.com, OpenTable, and Kayak.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

As the COVID-19 pandemic dealt a blow to the travel industry, it is important to be aware of the risks associated with BKNG. Let’s take a look at the company’s latest financial performance and risk factors.

Q2 Financial Performance

The company released its second-quarter financial results on August 4. Looking at the print, revenue increased 243% year-over-year to $2.2 billion and surpassed the consensus estimate of $1.9 billion.

Additionally, the adjusted loss per share of $2.55 narrowed 76% from the loss reported in the year-ago quarter, but compared unfavorably to the Street’s estimate of a loss per share of $2.10.

Notably, Booking Holdings said that it recorded $137 million in expenses in Q2 related to the return of government aid it had received. The company voluntarily decided to return the funds. (See Booking stock charts on TipRanks)

Risk Factors

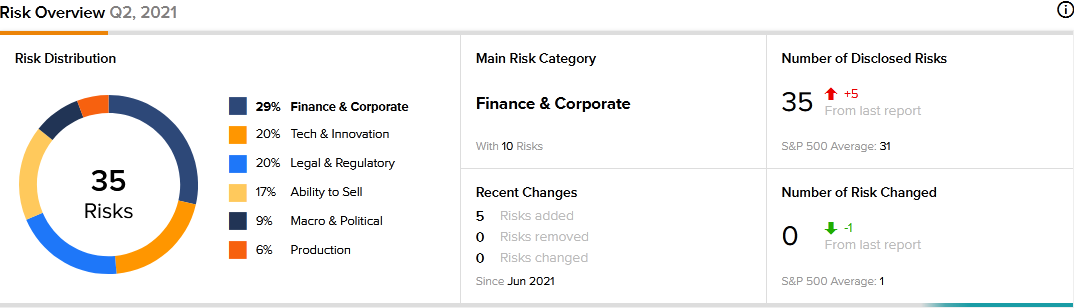

According to the new TipRanks Risk Factors tool, Booking now carries 35 risk factors, compared to 30 previously. The top risk category is Finance and Corporate at 29% of the total risks. Tech and Innovation and Legal and Regulatory are the next two major risk categories at 20% each.

Since June 2021, Booking has added five new risk factors. A newly added risk factor in the Finance and Corporate category cautions about potential financing challenges. The company has $2 billion under a revolving credit facility that comes with certain conditions. Additionally, the company states that if its credit rating were to be downgraded, its financing costs would be adversely impacted.

Meanwhile, a newly added Tech and Innovation risk factor highlights the fact that cyberattacks have increased during the COVID-19 pandemic. Booking warns that its existing measures may not prevent security breaches. If its systems were to be breached, the company could experience potential disruption to its operations, loss of market share, and damage to its brand reputation.

Wall Street’s Take

Following Booking’s Q2 earnings release, Stifel Nicolaus analyst Scott Devitt reiterated a Hold rating on Booking but raised the price target to $2,450 from $2,400. Devitt’s new price target suggests 12.23% upside potential.

“Booking’s effective strategy to extend its share organically in a secular growth market has demonstrated the strength of the platform’s competitive moat over time…The company is well-managed and generates significant cash flow, however, we remain Hold rated as we look for better visibility into the growth trajectory of the business and margin opportunity. Current conditions in the travel industry remain very challenged due to the COVID-19 outbreak,” commented Devitt.

Consensus among analysts is that BKNG is a Hold based on 2 Buys and 6 Holds. The average Booking price target of $2,533.57 implies 16.06% upside potential to current levels.

Related News:

Twist Bioscience Tanks 10.8% on Wider-Than-Expected Q2 Loss

Baidu Launches New Generation Multipurpose Autonomous Minibuses in China

Broadwind Energy Q2 Results Beat Estimates; Shares Fall 7.4%