New York-based Blade Air Mobility (BLDE) operates a platform that lets users take helicopters to the airport to avoid holdups on congested city roads. Travelers can also use the platform to book seats on scheduled flights or arrange private flights. Additionally, medical facilities can use Blade to arrange the delivery of human organs for transplant.

Blade’s earnings report shows its revenue increased 144% year-over-year to $20.3 million in Fiscal Q4 2021 ended September 30, beating the consensus estimate of $13.5 million. Net losses widened to $9.2 million from $0.7 million in the same quarter last year.

Blade recently acquired Trinity Air Medical to bolster its organ transportation business. It has also recently bought Helijet’s scheduled air mobility operation to bolster its helicopter services.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Blade.

Risk Factors

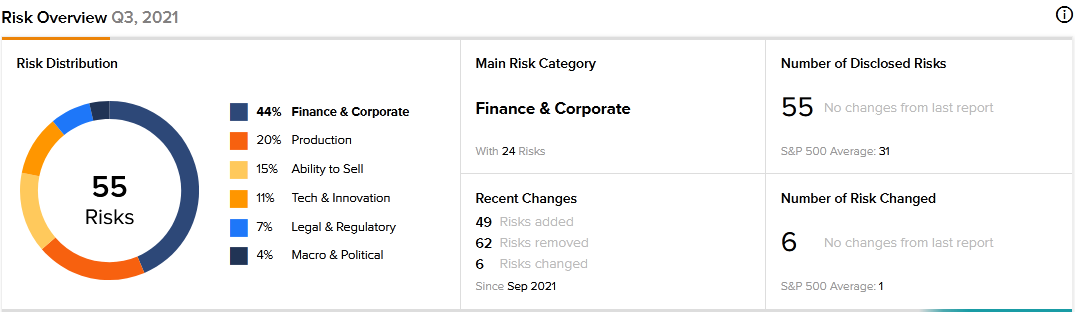

According to the new TipRanks Risk Factors tool, Blade’s main risk category is Finance and Corporate, representing 44% of the total 55 risks identified for the stock. Production and Ability to Sell are the next two major risk categories, accounting for 20% and 15% of the total risks, respectively. Blade recently updated its profile with 49 new risk factors across the various categories.

Although Blade ended Q4 with $305 million in cash to support growth, the company tells investors that it may sell additional shares in the future to raise more money to fund potential acquisitions and repay outstanding debts. It cautions that additional share sales may cause the stock price to decline and dilute the voting power of existing shareholders. Further, the company cautions that offering more shares would decrease the amount of cash per share that investors may receive if it decides to distribute dividends in the future.

Blade informs investors that it has been making losses since its inception. It cautions that it expects to continue making losses in the foreseeable future. It goes on to say that while it may turn a profit at some point, it may be unable to maintain profitability.

Blade intends to continue pursuing strategic acquisitions. But it cautions that the acquisitions may not deliver the anticipated benefits. Furthermore, integrating the acquired businesses may divert resources from the core business and disrupt operations.

The company tells investors that it relies on third parties to operate its branded aircraft. Blade warns that improper conduct by third-party operators could harm its reputation and adversely affect its business. The company goes further to caution that failure by the third-party operators to perform as expected could force it to delay or cancel flights, which could result in losses to the business.

The Finance and Corporate risk factor’s sector average is 36%, compared to Blade’s 44%. Blade’s stock has declined 15% year-to-date.

Analysts’ Take

Oppenheimer analyst Jason Helfstein recently reiterated a Buy rating on Blade stock but lowered the price target to $13 from $14. Helfstein’s new price target suggests 38.30% upside potential.

Consensus among analysts is a Moderate Buy based on 2 Buys. The average Blade Air Mobility price target of $14 implies 48.94% upside potential to current levels.

Related News:

Team BMO Donates C$26M in 2021

IA Financial Gives C$500K to Food Banks Canada

Canaccord Genuity to Buy Sawaya Partners