Texas-based AST SpaceMobile (ASTS) is building a space-based global cellular broadband network. The company is collaborating with mobile network operators to bring cellular broadband connectivity to more people around the world. AST SpaceMobile went public in April 2021 through a merger with a blank-check company. (See Top Smart Score Stocks on TipRanks)

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Let’s take a look at the company’s latest financial performance, business updates, and newly added risk factors.

Q2 Financial Results

AST SpaceMobile reported revenue of $2.77 million for Q2 2021, compared to $402,000 in the same quarter last year. It posted a loss per share of $0.39. The company ended Q2 with $402.6 million in cash and no debt.

Business Updates

AST SpaceMobile plans to launch its BlueWalker 3 prototype spacecraft in March 2022 with the help of SpaceX. As it prepares for the BlueWalker 3 launch, the company is progressing with the buildout of its Midland facility.

AST SpaceMobile has reached out to MTN Group to discuss testing on the BlueWalker 3 in two countries. It also has agreements with UT Mobile, Africell, LIBTELCO, MUNI, and other operators. The company now has agreements with operators serving 1.5 billion subscribers combined.

Risk Factors

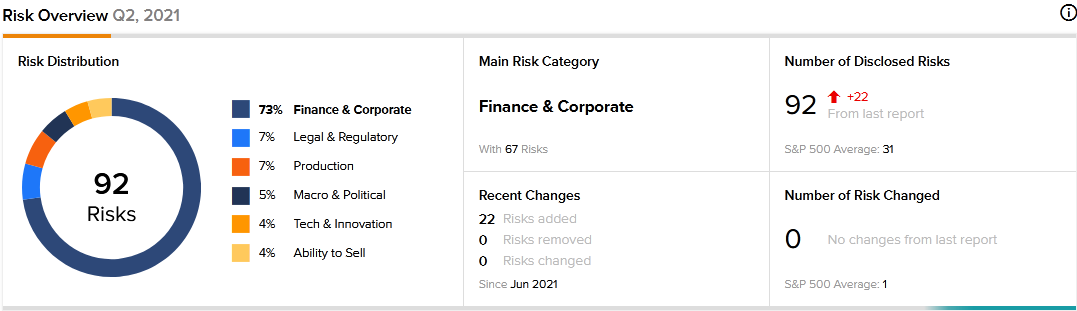

The new TipRanks Risk Factors tool shows 92 risk factors for AST SpaceMobile. Since June 2021, the company has updated its risk profile with 22 new risk factors.

AST SpaceMobile tells investors that it will incur significant expenses to develop its SpaceMobile service. It estimates the project will cost between $1.7 billion and $1.9 billion. The first phase of the space network buildout is expected to cost $260 million to $300 million. The company says these funds may not be available on acceptable terms. Therefore, it warns that if it cannot raise the required funds to complete the project, its prospects could be adversely affected.

AST SpaceMobile warns that its SpaceMobile Service could become less competitive or obsolete as a result of rapid technological changes.

The company says that it depends a lot on the services of its CEO Abel Avellan. Therefore, it warns that its ability to compete could be unfavorably affected if it cannot retain the executive.

AST SpaceMobile cautions that it may not achieve its anticipated growth because it will rely on third parties to offer its services to consumers. But the third parties may decide to offer competing services or may not agree to commercial terms that are acceptable to the company.

The majority of AST SpaceMobile’s risk factors fall under the Finance and Corporate category, with 73% of the total risks. That is above the sector average of 50%. AST SpaceMobile’s shares have declined about 26% since the beginning of 2021.

Analysts’ Take

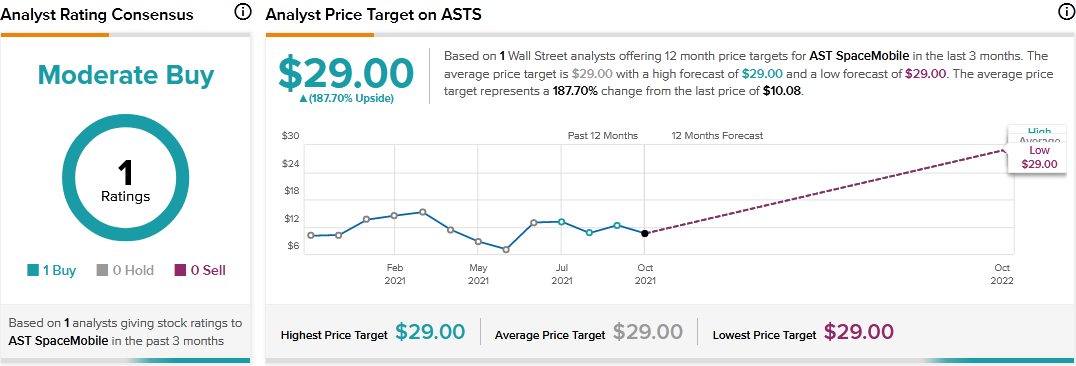

In July, Barclays analyst Mathieu Robilliard initiated coverage of AST SpaceMobile stock with a Buy rating and a price target of $29. Robilliard’s price target suggests 187.70% upside potential.

The analyst sees a significant market opportunity for AST SpaceMobile as its technology promises to help bridge the digital divide that is a priority for many governments.

Related News:

Emerson Electric Inks Deal with AspenTech to Accelerate Software Strategy

Chevron Targets to Achieve Net-Zero Carbon Emissions by 2050

ExxonMobil to Develop Large-Scale Plastic Waste Advanced Recycling Facility