Scottsdale, Arizona-based AMMO, Inc. (POWW) produces and sells ammunition products. It serves military, law enforcement, sport shooting, and self-defense markets. AMMO recently acquired GunBroker, a leading online marketplace for firearms.

Fiscal 2021 First-Quarter Outlook

On July 8, AMMO announced an update to its Fiscal 2022 first-quarter earnings guidance. It said it now expects to report revenue of $44 million for the quarter ended June 30, which would represent a 354% year-over-year growth. The company previously guided for revenue of $41 million, which it said would include two months of contribution from GunBroker.

In addition to raising the revenue guidance, AMMO also expects to report its first profitable quarter in its history. The company was founded in 2016. AMMO plans to report its Q1 results on August 16.

AMMO CEO Fred Wagenhals commented, “The Company’s growth trajectory is a testament to the hard work of our dedicated team of professionals…and our manufacturing team will continue their tireless work to ensure we exceed production expectations needed to address the continuing high consumer demand for our products.” (See AMMO stock charts on TipRanks)

AMMO’s Risk Factors

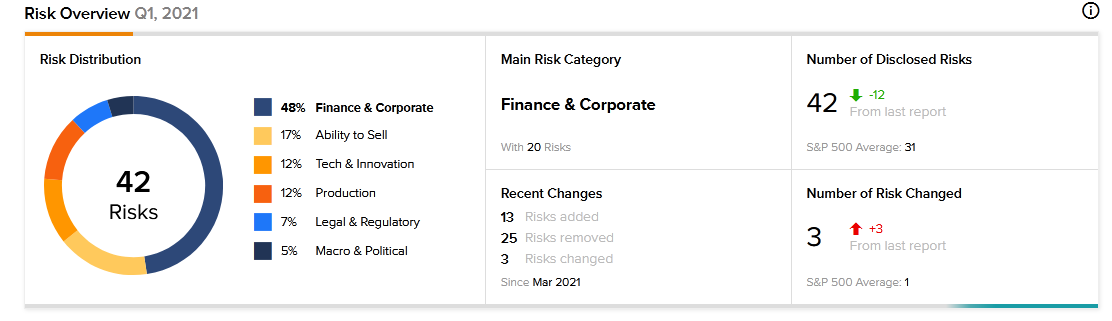

According to the new Tipranks Risk Factors tool, AMMO’s primary risk category is Finance and Corporate, accounting for 48% of the 42 risks identified. AMMO’s total number of risks identified declined from 54 in the previous report. The Ability to Sell is the next major risk factor at 17%. Tech and Innovation and Production are also highlighted as major risks at 12% each.

Since its Fiscal 2021 report, AMMO has revised its risk profile, removing 25 risks and adding 13 new risks. The vast majority of the newly added risks fall under the Finance and Corporate category and predominantly relate to AMMO’s Series A preferred stock. The company cautions that the stock may not offer investors adequate liquidity. It also says it may not pay dividends if it lacks sufficient cash resources.

AMMO added one new risk under Production, and it relates to its exclusive licensing agreement with the University of Louisiana at Lafayette. It says losing the license could significantly harm its operations.

The Finance and Corporate risk factor’s sector average is 38%, compared to AMMO’s 48%. The company’s shares are up about 270% over the past year.

Analysts’ Take

Lake Street analyst Mark Smith recently reiterated a Buy rating on AMMO stock and raised the price target to $11 from $9. Smith’s price target suggests 32.85% upside potential.

The analyst reaffirmed his bullish view after AMMO reported better than expected fourth-quarter results and completed the acquisition of GunBroker. Smith also noted continued industry tailwinds.

Consensus among analysts is a Moderate Buy based on 2 Buys, with an average AMMO price target of $11 per share.

Related News:

UniCredit Setting up Tech Innovation Hub in Naples, Italy

United to Expand Winter Schedule with 150 Additional Flights

Apple Eyes NFL Rights to Bolster Apple TV+ Streaming Service Offerings – Report