British pubs group J D Wetherspoon (LON: JDW) warned on Wednesday it would post a loss for the first half of the fiscal year after the Omicron variant led to new restrictions and kept people out during the holidays.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Sales Hurt By Restrictions

The company said like-for-like sales fell 11.7% and total sales 13.3% in the 25 weeks to January 16 as second-quarter sales were hit by restrictions imposed by Britain in December.

In the 12 weeks to January 16, 2022, like-for-like sales fell 15.6% and total sales fell 16.6% compared to the same period last year.

Commenting on revelations that a number of parties took place at 10 Downing Street during the lockdown in 2020, Wetherspoon said the parties highlighted the consequences of lockdowns and pub closures.

Outlook

J D Wetherspoon chairman Tim Martin, said, “As mentioned in our update on 13 December 2021, the uncertainty created by the introduction of plan B Covid-19 measures makes predictions for sales and profits hazardous. The company will be loss-making in the first half of the financial year, but hopes that, with the ending of restrictions, improved customer confidence and better weather, it will have a much stronger performance in the second half.”

Wall Street’s Take

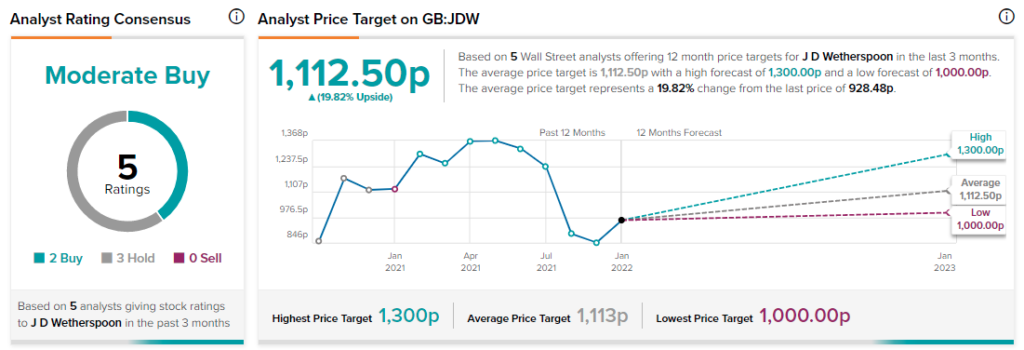

Two months ago, Jefferies analyst James Wheatcroft kept a Buy rating on JDW while lowering its price target to 1,300p (from 1,675p). This implies 40% upside potential.

Overall, JDW scores a Moderate Buy analyst consensus rating based on two Buys and three Holds. The average J D Wetherspoon price target of 1,112.50p implies 19.8% upside potential to current levels.

Download the TipRanks mobile app now

Related News:

Hotel Chocolat Q2 Revenue Rises 37%

Sainsbury Sales Down in Q3, Profit Target Raised