Shares in US money transfer company MoneyGram (MGI) spiked 32% in after-hours trading on Monday on reports of takeover talks with Western Union (WU). On the news Western Union also surged 6% after-hours.

According to a Bloomberg report, Western Union has already made a takeover offer for MoneyGram, but no decision has been made and Western Union could choose to proceed without a deal.

MGI is the second largest money transfer player with ~350K agents around the world, and a fast growing self-service (kiosk) and online presence which are 15% of money transfer revenues.

However the company has struggled recently, with 1Q revenues of $290.9M declining 8% y/y, and April transactions down 19% y/y. This was despite the fact that April saw significant growth in digital transaction with a 75% increase.

Northland Securities analyst Michael Grondahl has a hold rating on MoneyGram, with a price target of just $1.

“Since MGI was recapitalized in 2008 (due to bond portfolio implosion) they have continued to tackle many internal and external issues, we believe this continues to be a long journey with a high gross debt level of ~$909M and weak cash flows” he explained.

Indeed, the stock shows a bearish Moderate Sell consensus from the Street. The average analyst price target of $1 now stands at 60% downside from the current share price. Shares are currently trading up 24% year-to-date.

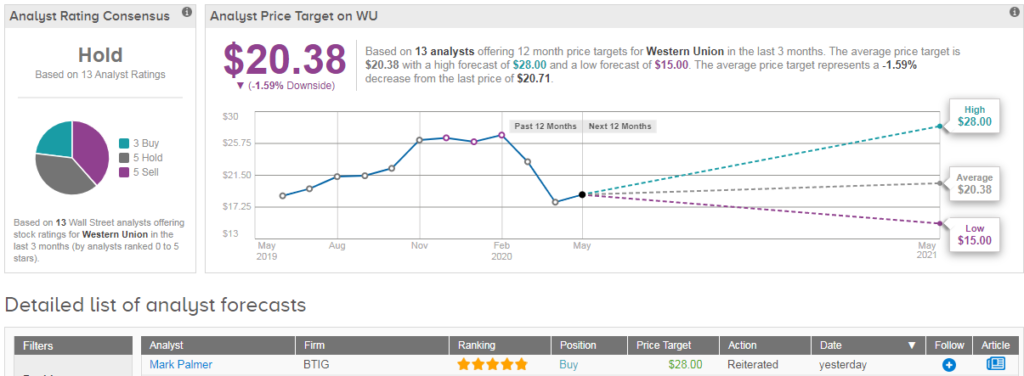

Meanwhile WU shows a Hold analyst consensus rating, with an average analyst price target of $20 (2% downside potential). “While we believe WU’s operating performance will be severely impacted by the COVID-19 pandemic in the near-term, we believe the company’s ample liquidity will enable it to weather the crisis” comments BTIG’s Mark Palmer.

He has a more bullish buy rating on the stock with a $28 price target (35% upside potential), based on separate valuations for the company’s traditional money transfer business and its rapidly growing digital business. (See WU stock analysis on TipRanks).

Related News:

KKR Joins $3.3 Billion Bid To Acquire Spanish Telecom Carrier Masmovil

Amazon’s Jeff Bezos Invests In UK Freight Startup Beacon

Zynga Snaps Up Peak For $1.8B In Its Largest Deal To Date; Shares Up 7%