U.S. stocks kicked off the third quarter last week. The S&P 500 closed Friday riding the momentum of a seven-session winning streak. Technology and Consumer Discretionary names led the way higher, while the Energy sector lagged. Elsewhere, the yield of the benchmark 10-year U.S. Treasury note declined to 1.43%.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Investors were emboldened by a solid June employment report on Friday. The U.S. economy added 850,000 non-farm payrolls last month and wages did not grow as quickly as expected.

Earlier in the week, it was reported that the Conference Board’s consumer confidence reading in June reached the highest level since the pandemic began. The U.S. economic recovery thesis remains strong, even as variants of COVID-19 continue to spread in pockets of the globe.

The Week Ahead

As a reminder, U.S. markets are closed on Monday for a holiday. The earnings calendar is light this week, but the second-quarter earnings season is right around the quarter.

According to Refnitiv, aggregate profit for the S&P 500 is expected to increase 65% from a year ago, leveraged from sales growth of 19%.

On the economic front, we’ll get the ISM Services reading on Tuesday. It follows a solid report from the Manufacturing side last week. In addition, we will see minutes from the latest FOMC meeting on Wednesday.

Following the snap-back recovery in stocks last year from Pandemic lows, we believe that investment gains will be harder to come by in 2021.

As a result, deciding what and when to buy can be challenging for any investor. However, the fact remains that attractive investments are out there if you’re willing to dig a little deeper. One such Consumer name is worth a closer look and is our Stock of the Week.

Stock of the Week: TJX Companies (TJX)

The company operates more than 4,500 discount stores in nine countries, under brands such as T.J. Maxx, Homegoods and Marshalls.

The stock gained fractionally last week and we believe this outperformance can continue into the second half of 2021. Here’s why:

The U.S. rapidly deployed COVID-19 vaccines this spring, allowing for more parts of the economy to sustainably re-open. Consumers have pent-up demand to get out and shop, which was reflected in TJX’s better-than-expected quarterly report back in May.

The retailer earned $0.44 a share in the April quarter, which surpassed the consensus analyst estimate. Revenue also increased 129% from a year ago to $10.09 billion and beat expectations.

In addition to the headline numbers, the company delivered 16% same-store sales growth last quarter, for locations that remained open during the pandemic. Despite supply-chain issues hampering various aspects of the global economy, TJX has inventory to keep its shelves full and meet higher consumer demand.

The shares are currently down 8% from recent highs, but management views this as an opportunity. The company announced plans in May to repurchase $1 to $1.25 billion of stock, by Jan. 2022.

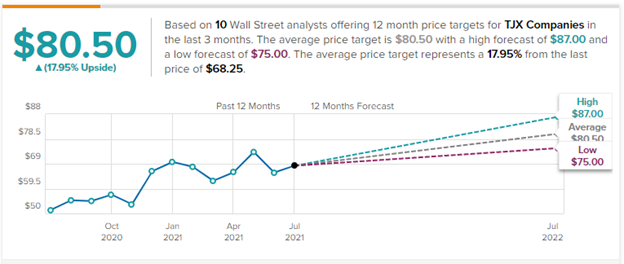

Wall Street agrees that the retailer has value at current levels. The average price target of 10 active analysts tracked by TipRanks is $80.50, which reflects 18% upside potential.

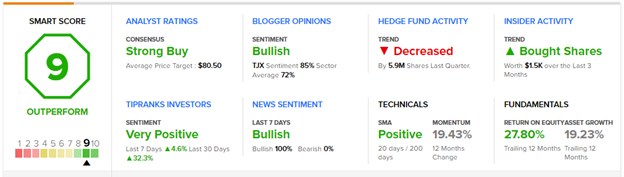

It’s additionally worth noting that TJX carries a Smart Score of 9/10 on TipRanks. This proprietary score utilizes Big Data to rank stocks based on 8 key factors that have historically been a precursor of future outperformance.

On top of the positive aspects mentioned already, the Smart Score indicates that shares have seen insider buying, in addition to improving sentiment from financial bloggers and individual investors.

FYI: This is just 1 of the 20+ stocks selected for the Smart Investor portfolio. That’s where we share more detailed insights on our weekly stock picks.