Shares of retail pharmacy giant Walgreens Boots Alliance (NASDAQ:WBA) are ticking lower today after the company delivered better-than-anticipated second-quarter numbers but narrowed its financial outlook.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Impressive Sales Gains

During the quarter, revenue increased by 6.3% year-over-year to $37.1 billion, outpacing estimates by $1.24 billion. EPS of $1.20 came in better than the consensus by $0.38. The quarter was marked by growth across all of WBA’s segments. U.S. Retail Pharmacy sales rose by 4.7% to $28.9 billion on the back of higher branded drug prices. Comparable pharmacy sales rose at an impressive 8.7% year-over-year.

Moreover, in its International segment, sales increased by 6.6% to $6 billion. While performance in the German and U.K. units improved by single digits, Boots.com clocked an impressive 16.8% sales growth.

Additionally, the acquisition of Summit Health by VillageMD helped WBA increase its U.S. Healthcare segment sales by an impressive 33.2% to $2.2 billion.

Bottom Line Falters

Operating loss for the quarter stood at $13.2 billion compared to an operating income of $197 million in the year-ago period. This result included a non-cash impairment charge of $12.4 billion related to VillageMD goodwill and non-cash charges of $455 million associated with certain long-lived assets in WBA’s U.S. Retail Pharmacy segment. Consequently, net loss for the quarter stood at $5.9 billion versus a net income of $703 million a year ago.

Narrowed Outlook

While WBA’s Q2 performance remained promising, the company narrowed its financial outlook for Fiscal Year 2024, attributing the change to a challenging retail environment in the U.S. The company anticipates an EPS of $3.20 to $3.35 for the year versus the prior estimate of $3.20 to $3.50. WBA also aims to achieve cost savings to the tune of $1 billion in 2024.

Is Walgreens a Buy, Sell, or a Hold?

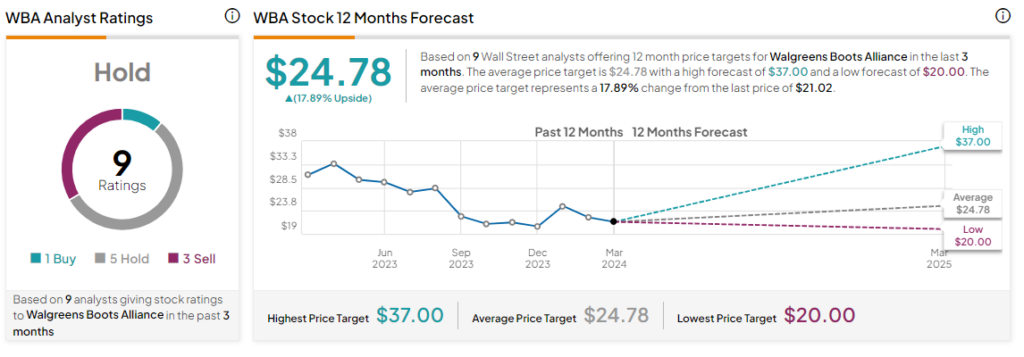

Today’s price decline further adds to the nearly 33.5% drop in WBA’s share price over the past year. Overall, the Street has a Hold consensus rating on Walgreens, and the average WBA price target of $24.78 implies a potential upside of 17.9% in the stock. However, analysts’ views on WBA stock could see a revision following today’s earnings report.

Read full Disclosure