Waymo, the self-driving unit of Alphabet (GOOGL), will be getting back on the road in the Bay Area roads for the first time since the company halted its public testing in early March because of the coronavirus outbreak.The Alphabet-owned company plans to return its fleet of autonomous minivans to service starting June 8th.

Waymo’s self-driving cars will be put to use delivering packages in order to comply with restrictions that have otherwise kept their autonomous vehicles off the road. Waymo, along with the rest of California’s AV companies, paused on-road testing in mid-March after the city issued a “shelter-in-place” order banning all nonessential travel. The order does not have a set end date.

Waymo’s robot minivans are already back on the road in Phoenix as well as the company’s private test facility in California’s Central Valley.

It’s unclear how many vehicles will be involved in the deliveries, or how many vehicle operators will be called back to work. Waymo has continued to pay its workers despite three months of downtime, while other self-driving companies have cut their operations staff.

“After careful consideration and active conversations with our teams, partners, and local and state authorities, we’ve begun over the last several weeks to resume our driving operations in Phoenix,” a Waymo spokesperson said in a statement. “Soon San Franciscans will also begin to see some Waymo vehicles back on the road, and we’re proud to provide charitable delivery support to community partners. The health and safety of our team is our number one priority as we begin to drive again in San Francisco.”

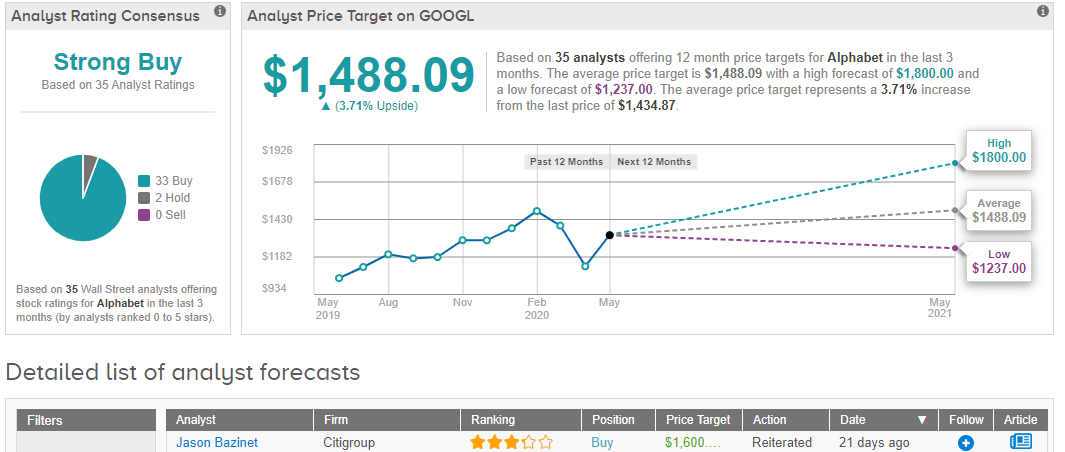

Google parent Alphabet’s stock has done well this year, rising 28%, even after falling significantly in early March. Wall Street consensus sees Alphabet as a Strong Buy, and the average analyst 12-month price target of $1488 leaves just over 3% upside potential. It closed on Monday at $1434 per share. (See Alphabet stock analysis on TipRanks).

In a recent note to clients, Canaccord Genuity’s Maria Ripps wrote: “We see Google likely benefiting as the pandemic could be a tailwind for ad budgets shifting online, momentum in Google Cloud supporting consolidated growth, and Other Bets providing optionality for patient investors. This, coupled with prudent expense management, a strong balance sheet, and share repurchases, gives us comfort around Alphabet’s ability to successfully withstand this [Covid-19-related] near-term disruption.”

Related News:

Google Mulling Purchase of Stake in Indian Vodafone Idea

Google Faces Arizona Lawsuit Over ‘Unfair’ Location Data Storing

Microsoft Seeks $2B Stake In India’s Jio Platforms- Report