The post-pandemic years have necessitated a strategy reset for several darlings of the lockdown era. For online furniture retailer Wayfair (NYSE:W), consumers’ return to brick-and-mortar formats after the COVID-19 pandemic resulted in net losses, slowing revenues, and a gargantuan 79% drop in its share price over the past three years. However, the company’s promising first-quarter results this week and strategy reset could signal a boost in its fortunes in the coming periods.

Wayfair’s Q1 Beat Expectations

Wayfair’s stock price shot up by 16% yesterday after its Q1 revenue of $2.7 billion came in better than expectations despite a 1.6% year-over-year drop. The furniture seller’s net loss per share of $0.32 also came in narrower than its net loss per share of $1.13 a year ago.

While the company witnessed a drop in its top line in the U.S. and its international markets, its active customers increased by 2.8% to 22.3 million. The somewhat improved performance comes amid Wayfair’s drive to lower costs and another round of layoffs earlier this year.

Wayfair’s Effort to Boost Performance

Additionally, the company is banking on a brick-and-mortar presence to boost its performance. Wayfair already operates multiple physical stores and is gearing up to open its first large-format store this month.

However, the current macroeconomic picture is far from promising amid tepid consumer demand and elevated interest rates. Consequently, it could be a while before the company completely turns its fortunes around. But it seems to be laying the right groundwork towards such a scenario.

What Is the Target Price for W Stock?

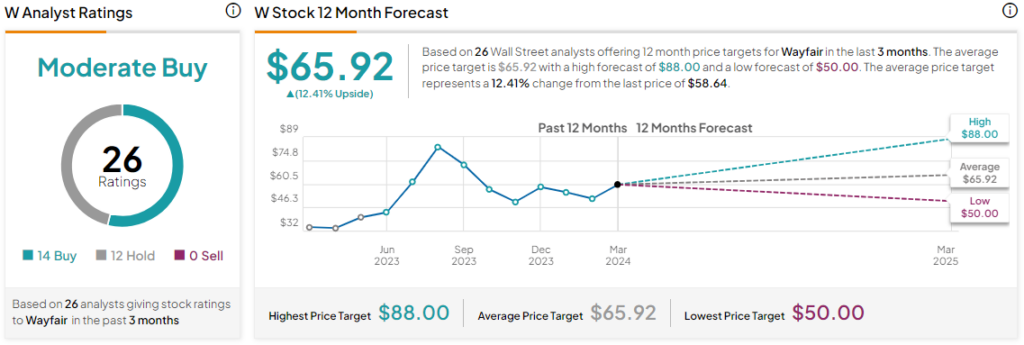

Overall, the Street has a Moderate Buy consensus rating on Wayfair. Furthermore, the average W price target of $65.92 implies a 12.4% potential upside in the stock.

Read full Disclosure