After an initial decline, Wayfair (NYSE:W) shares gained nearly 6% today following the eCommerce company’s announcement of its third-quarter results. During the quarter, revenue increased by 3.7% year-over-year to $2.9 billion, slightly missing expectations by $80 million. EPS of -$0.13, on the other hand, outpaced expectations by a wide margin of $0.34.

Wayfair’s U.S. net revenue increased by 5.4% to $2.6 billion, while its International net revenue decreased by 7% to $372 million. Despite a 1.3% decline in the number of active customers to 22.3 million, the company clocked a 13.8% increase in order deliveries to 9.9 million.

Importantly, the number of Wayfair’s orders from repeat customers surged by 16.2% to 7.9 million orders, and the company achieved positive free cash flow for the second consecutive quarter. However, amid the present macroeconomic environment, its average order value declined to $297 from $325 in the year-ago period.

Is Wayfair a Good Stock to Buy Right Now?

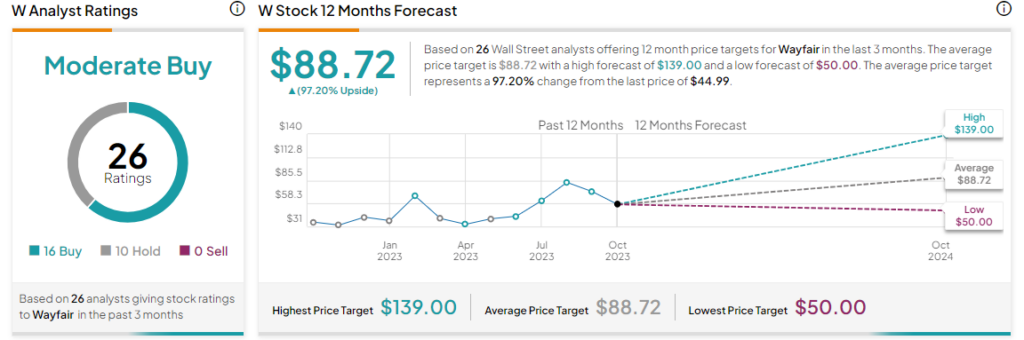

Overall, the Street has a Moderate Buy consensus rating on Wayfair. The average W price target of $88.72 implies a substantial 97.3% potential upside. That’s on top of a nearly 40% rise in Wayfair stock over the past six months.

Read full Disclosure