Watches of Switzerland Group (GB:WOSG) today confirmed its FY25 guidance, sending its share price soaring. The company expressed confidence in its outlook, stating that trading in the first 18 weeks aligned with its expectations. This came as a relief for investors after a sluggish period for the luxury watch and jewellery market. WOSG gained nearly 6% as of writing.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Year-to-date, Watches of Switzerland stock has declined by over 40%, largely due to the profit warning issued by the company for FY24 in January.

Watches of Switzerland (WoS) is a global manufacturer and retailer of high-end luxury watch brands, including Rolex, Cartier, Chopard, Hamilton, and Longines.

WoS Sees Higher Demand as Luxury Market Rebounds

According to the trading update, demand for Watches of Switzerland’s key luxury brands remains strong in both the UK and U.S. markets. In fact, demand is exceeding supply. Among these regions, the UK market has stabilized after experiencing economic challenges. Meanwhile, in the U.S., stock levels are being increased to boost displays and client experience, with growth expected to be weighted towards the second half of FY25.

In FY24, the company’s profit dropped 40% to £92 million due to higher cost-of-living pressures. However, the company indicated in June that it was beginning to see signs of improved trading, as consumer confidence started to recover.

WoS Confirms FY25 Guidance

Looking ahead, WoS forecasts revenue growth of 9% to 12% for FY25 at constant currency and an improved adjusted EBIT (Earnings Before Interest and Taxes) margin. For FY24, the adjusted EBIT margin stood at 8.8%, down from 10.7% in FY23.

The company will announce its half-yearly results on December 5, 2024.

Is Watches of Switzerland Stock a Buy or Sell?

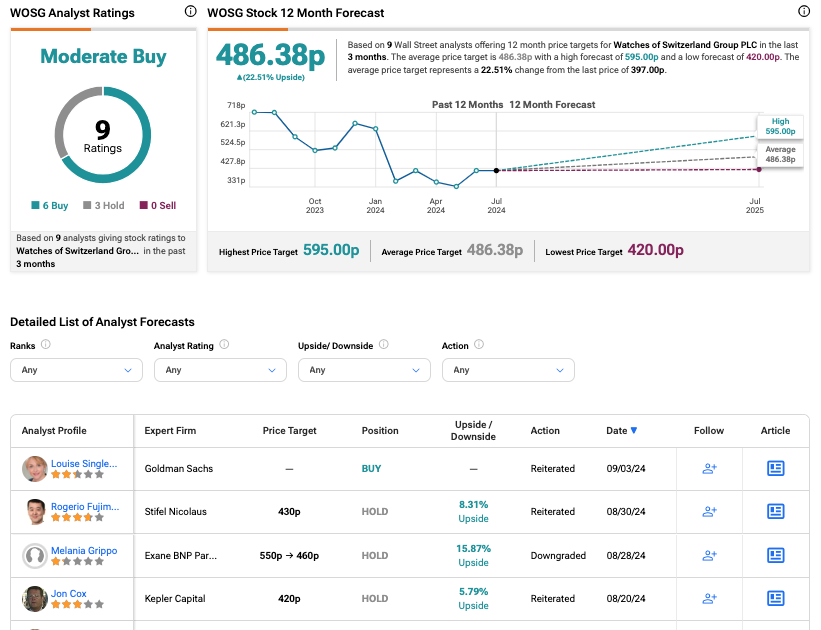

Following a favourable update, Goldman Sachs analyst Louise Singlehurst confirmed a Buy rating on the stock.

Overall, according to TipRanks, WOSG stock has a Moderate Buy consensus rating based on six Buy and three Hold recommendations. The WOSG share price target is 486.38p, which is 22.5% above the current share price level.