Palantir (NYSE:PLTR) has risen 161% in 2024, emerging as one of the year’s top-performing stocks. Its effective embrace of AI innovations has fueled this momentum, driving profitability and attracting a growing roster of government and corporate clients.

The flip side of this rapid rise is an exceptionally high valuation, that by any metric soars above the rest of Palantir’s peers.

Despite the high price tag, an investor known as Geneva Investors remains highly bullish on the big data analytics company.

“I see the stock as an asymmetric bet on the company maturing rapidly and emerging as a leading AI SaaS player,” writes the investor.

Geneva highlight several catalysts supporting Palantir’s continued growth, with the foremost being the new Warp Speed backend software platform, designed to expand business within the manufacturing sector.

“Warp Speed should allow Palantir to address critical challenges in manufacturing and supply chains, offering advanced backend solutions that drive supply chain efficiency,” writes the investor.

Beyond manufacturing, Geneva is optimistic about Palantir’s potential to expand into healthcare and oil and gas, with partnerships such as those with Nebraska Medicine, Mount Sinai, APA, and BP.

The investor is particularly enthused by Palantir’s collaboration with AT&T, viewing it as a sign of future growth potential. “The fact that Palantir was able to penetrate such a complex organization, I believe, is a testament to just how much value the company can add when integrating within existing systems,” Geneva notes.

Geneva also highlights two events as key opportunities to showcase Palantir’s offerings and attract new clients. The November DevCon – a developer conference – is geared for highly technical personnel, and should give Palantir “a more direct approach to convincing key decision-makers and gatekeepers at prospective companies.”

Meanwhile, Palantir recently held its fifth AIPCon in September, marking the fifth customer-focused event in just 18 months. These gatherings have already shown their ability to drive significant engagement while “proving the platform’s scalability and traction.”

Geneva further emphasizes Palantir’s unique culture, which is evident in the rise of the “Palantir Mafia,” a network of company alumni that has founded successful new ventures. “Palantir is cultivating a generation of entrepreneurs who are now shaping different industries,” writes the investor.

Geneva is therefore undeterred by PLTR’s high valuation, and rates the stock a Strong Buy. (To watch Geneva Investors’ track record, click here)

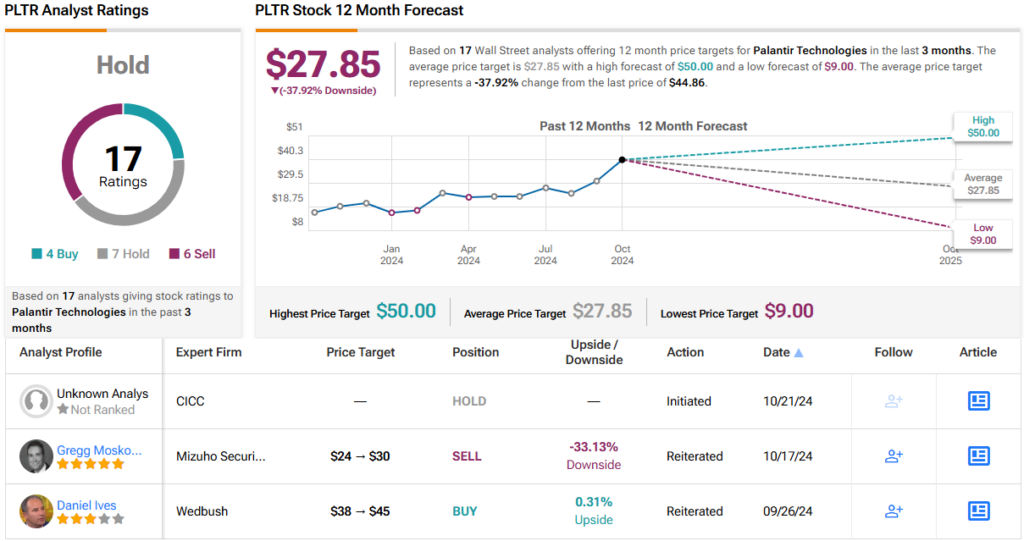

Geneva’s optimism is higher than that of Wall Street analysts, some of whom are wary of Palantir’s high valuation. The stock holds a consensus Hold rating, with 4 Buy, 7 Hold, and 6 Sell ratings, and an average 12-month price target of $27.85, suggesting a potential ~38% downside. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Questions or Comments about the article? Write to editor@tipranks.com