Berkshire Hathaway (BRK.B), the conglomerate led by billionaire investor Warren Buffett, has reduced its workforce by over 4,000 jobs in the past year. Despite this, the firm is on track to report a record annual operating profit. It is also worth noting that as of its latest regulatory filing, Berkshire’s operating businesses employ approximately 392,000 people.

Berkshire’s business model involves acquiring and holding strong companies for the long term. In addition, under Buffett’s leadership since 1965, Berkshire has maintained a decentralized approach by allowing its subsidiaries to operate independently. However, the company is still willing to make job cuts when necessary to adapt to changing markets or business priorities. For example, Geico, a Berkshire-owned car insurer, cut 7,700 jobs in 2023 due to underwriting losses.

Nevertheless, Berkshire has reported impressive operating profits overall in recent years, with a record $37.35 billion in 2023 and $32.91 billion in the first nine months of 2024. The company is expected to release its full-year results for 2024 in late February. Analysts are expecting earnings per share to come in at $4.62 on revenue of $92.16 billion.

Is Berkshire Hathaway Stock a Buy, Sell, or Hold?

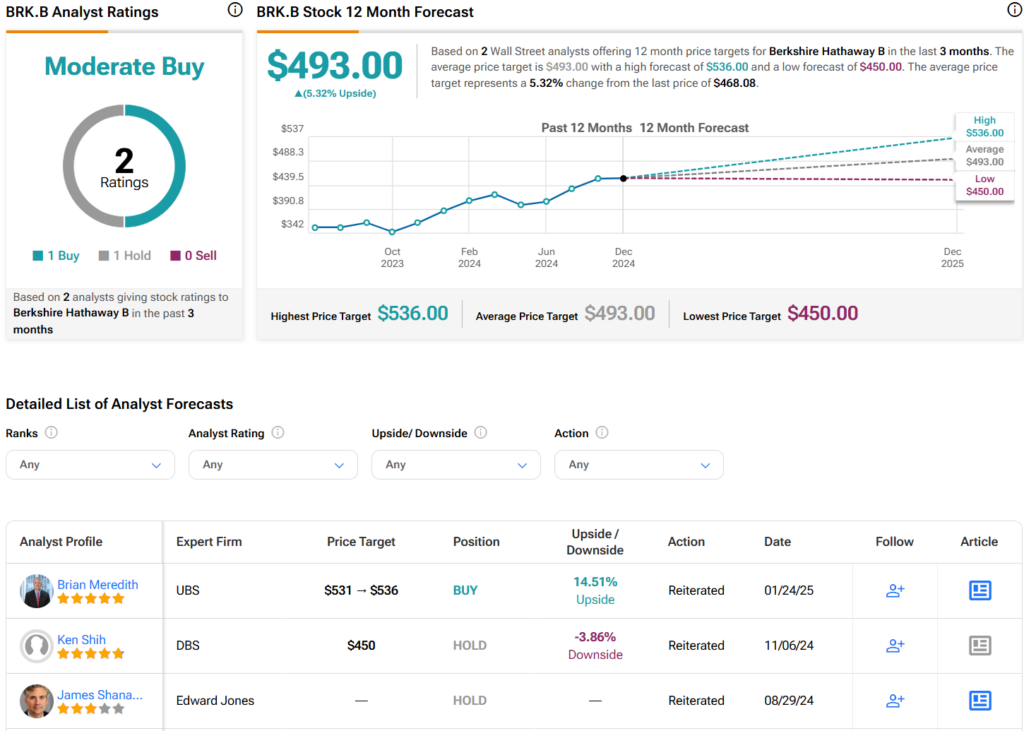

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BRK.B stock based on one Buy and one Hold assigned in the past three months, as indicated by the graphic below. After a 21% rally in its share price over the past year, the average BRK.B price target of $493 per share implies 5.3% upside potential.