Penn National Gaming (NASDAQ:PENN) was in the market’s doghouse today, and you may be tempted to gamble your money since the shares look cheap. Yet, after digging deeper, I think you’ll find that Penn National Gaming’s fundamental figures don’t currently justify an investment. Thus, I am bearish on PENN stock and think that people should just avoid it.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Penn National Gaming provides platforms for online gambling, which often involves sports betting. During the onset of the COVID-19 pandemic, some speculative traders bought Penn National Gaming stock because online gambling was a red-hot market that seemed unstoppable.

Today’s environment is quite different, though. Interest rates are high, and the cost of most products is elevated compared to 2020. This raises the question of whether the online gambling business is viable in 2024. Now, Penn National Gaming has to demonstrate its value to the shareholders, and after viewing the company’s financials, you might want to put your chips on another company.

Is Penn National Gaming’s ESPN Team-Up a Success?

Last year, Penn National Gaming proudly announced the launch of ESPN BET, an online sportsbook platform, in 17 U.S. states. PENN Entertainment CEO and President Jay Snowden touted this team-up between his company and ESPN as a “successful launch,” adding, “PENN’s operational excellence paired with ESPN’s unmatched brand and reach is a powerful combination that will drive this compelling new sportsbook.”

Fast-forward to mid-February, and Snowden is still bragging. He recently declared, “ESPN BET attracted significantly more first-time depositors (FTDs) than we anticipated, which drove higher than expected promotional expense.” This sounds like an excuse as much as a brag, so let’s break down the numbers and see how ESPN BET is really doing.

Under the heading “Successful ESPN BET Launch,” Penn National Gaming reported Interactive Segment revenue of $31.5 million, along with an adjusted EBITDA of -$333.8 million. Now, we can clearly see the impact of what Snowden called ESPN BET’s “higher than expected promotional expense.”

This is a textbook example of why informed investors should always scrutinize the actual numbers instead of just listening to the hype and braggadocio of corporate executives in press releases. Snowden sounds like an excellent hype man, and that’s part of his job, but ESPN BET could prove to be a costly long-term partnership for Penn National Gaming.

Penn National Gaming’s Financials Fall Short

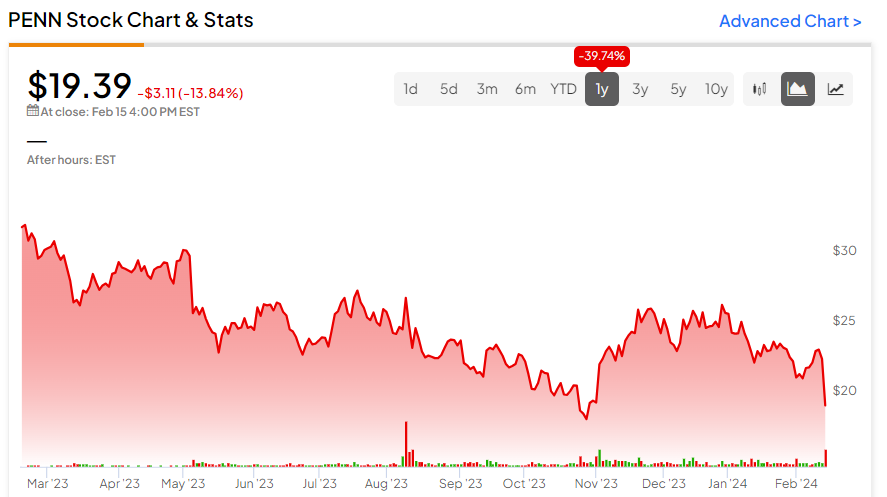

Today, the once-loved Penn National Gaming was out of favor, and the stock fell by 13.8%. It appears that the market just isn’t in the mood to gamble on a money-losing business like Penn National Gaming.

Rewinding the clock a bit, 2023’s third quarter was a disaster for Penn National Gaming. Analysts had forecast quarterly earnings of $0.37 per share, but Penn National Gaming ended up reporting a loss of $4.80 per share.

The company had a chance to redeem itself in the fourth quarter of 2023. Penn National Gaming just released its results for that quarter, and the numbers aren’t encouraging.

As it turns out, PENN reported a loss of $2.37 per share in Q4 2023. That’s considerably worse than the loss of $0.57 per share that Wall Street had predicted. It’s also a major fall-off when compared to the earnings of $0.13 (positive, not a loss) per share that Penn National Gaming had reported in the year-earlier quarter.

What about the company’s revenue? For 2023’s fourth quarter, analysts expected the company to generate revenue of $1.54 billion. The actual result was $1.395 billion, so that’s another miss for Penn National Gaming. Moreover, this result represents a revenue decline when compared to the $1.586 billion that Penn National Gaming generated in the fourth quarter of 2022.

Finally, we can’t ignore PENN’s capital position. At the end of 2022, the company had $1.624 billion worth of cash and cash equivalents. Then, at the end of 2023, Penn National Gaming’s cash and cash equivalents had dwindled to $1.072 billion. That’s a rapid rate of cash burn, and it certainly doesn’t bode well for Penn National Gaming.

Is PENN Stock a Buy, According to Analysts?

On TipRanks, PENN comes in as a Moderate Buy based on four Buys and nine Hold ratings assigned by analysts in the past three months. The average Penn National Gaming stock price target is $29.08, implying 50% upside potential.

Conclusion: Should You Consider PENN Stock?

In 2020 and 2021, it probably seemed like a good idea to bet on a company like Penn National Gaming. Stock traders were in a risk-on, speculative mood. The future seemed bright for Penn National Gaming, and perhaps the company’s fundamentals weren’t a major concern.

Nowadays, people aren’t as loose with their money. Unprofitable businesses are under pressure due to high borrowing costs. So, PENN has the burden of demonstrating that it’s a viable business venture in 2024.

Unfortunately, the firm’s financial stats don’t seem to support a gamble on this risky company. The CEO can brag about ESPN BET if he wants to, but this partnership might end up being too costly for Penn National Gaming. Consequently, I am bearish on PENN stock and am not considering buying it now.