It is not exactly a positive climate for mergers and acquisitions (M&A) right now. With the Federal Trade Commission dominated by an activist chair who pretty much bursts into flame whenever she hears the word “merger,” trying to combine a company is a tough proposition. Therefore, media giant Warner Bros Discovery (WBD) is biding its time accordingly and hoping for better conditions ahead. Investors were all in favor, and shares shot up over 4% in Friday afternoon’s trading.

Warner is finding it tough to make merger deals these days. It has been considering a consolidation move to give the company some breathing room and make it more attractive in a field with a lot of competition and a rapidly changing landscape. Even Comcast (CMCSA) found itself largely uninterested in buying or merging with Warner.

But David Zaslav, Warner’s CEO, thinks the problem is less about Warner’s standing and more about the government, which has been very tightly against merger and acquisition operations. That’s why Zaslav and those like him are looking for a change in government to break the logjam and get media companies interested in consolidation again.

Do People Not Like Warner’s Content?

Zaslav does make a point. A lot of similar efforts have been quashed by a zealous government of late. But that’s got some wondering; does no one want to merge with Warner because it’s pointless, thanks to the government, or because no one particularly likes Warner content? Well, Disney (DIS) seems to think people like the content, as it recently brought out a new package bundle featuring Disney+, Hulu, and Warner’s Max for as little as $16.99 a month for an ad-supported tier.

However, Warner is having trouble getting and holding on to sports content. It recently lost a bid to get the NBA back from Amazon (AMZN) and is going to court over the matter.

Is Warner Bros. Discovery Stock a Good Buy?

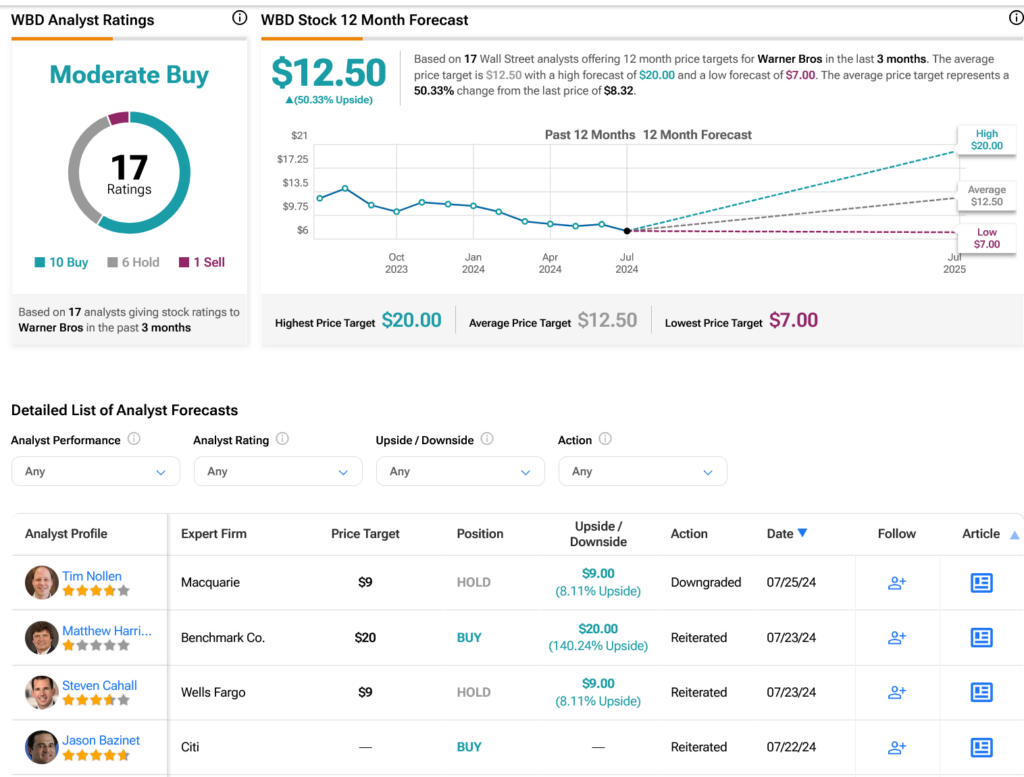

Turning to Wall Street, analysts have a Moderate Buy consensus rating on WBD stock based on 10 Buys, six Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 32.3% loss in its share price over the past year, the average WBD price target of $12.50 per share implies 50.33% upside potential.