Eyewear products manufacturer Warby Parker Inc. (NYSE: WRBY) stirred the market sentiment on Thursday after delivering better-than-expected results for the second quarter of 2022. The company also disclosed the benefits of its cost savings initiatives (that included a 15% cut in corporate jobs) for 2022.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shares of this $1.6-billion company increased 19.2% to close at $16.90 on Thursday. Surprisingly, investors seem to have completely ignored the company’s lowered revenue projections for 2022.

The Co-Founder and Co-CEO of Warby Parker, Neil Blumenthal, said, “Q2 was another quarter where Warby Parker made strong progress against our core strategic growth initiatives, gained market share, and delighted customers despite shifts in consumer spending.”

What Is Warby Parker Famous For?

The popularity of this New York-based company increased manifold after it went public in September 2021. It is especially known for eyeglasses, sunglasses, and lenses. In addition to these products, Warby Parker conducts vision tests and eye exams and offers accessories like pouches, anti-fog sprays, and cases.

Warby Parker’s Encouraging Q2 Performance in Detail

The company’s results seem to have improved in the second quarter of 2022. Its losses were $0.01 per share, compared to the consensus estimate of $0.02 loss per share. Also, the bottom line improved from the loss of $0.09 per share a year ago.

Revenues of $149.6 million in the quarter were 0.1% above the consensus estimate of $149.5 million. On a year-over-year basis, the top line grew 13.7%, driven by an 8.7% increase in active customers and an 8.2% surge in average revenue per customer.

The year-over-year growth in the footfall to the company’s website reflects health demand for products and services. According to TipRanks, traffic to the company’s website (estimated) grew 10.1% year-over-year in the second quarter of 2022. Learn how Website Traffic can help you research your favorite stocks.

Margin Profile & Cash Position of Warby Parker

Margin profile and cash position have weakened for Warby Parker. In the second quarter, a year-over-year increase of 17.8% in costs of revenues and a 22.3% rise in operating expenses eroded the company’s margins. The adjusted gross margin decreased 140 basis points (bps) to 57.9%, and the adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) margin was down 420 bps to 4%. High salary and benefit costs to optometrists, and increased overhead and salaries of retail employees played spoilsports in the quarter.

The company noted that it took actions to restructure its team, which included the elimination of a 15% headcount (63 people) engaged in corporate activities in the second quarter.

Meanwhile, cash and cash equivalents were $211.6 million at the end of the second quarter of 2022 versus $256.4 million at the end of 2021. The lower balance includes the impact of $14.6 million used for operating activities and $31.9 million spent on capital expenditures.

Warby Parker’s Projections for 2022

The company anticipates revenues of $584-$595 million in 2022, reflecting year-over-year growth of 8% to 10%. Earlier, the company had predicted $650-$660 million in revenue, which suggested a 20% to 22% increase from 2021.

The adjusted EBITDA margin is expected to be 3.8%-4.4% versus 5.6%-6.6% projected earlier.

Contrary to the abovementioned revisions, the company expects to open 40 new stores in 2022. Exiting the second quarter, the company had 178 stores, including nine opened during the quarter.

The company’s CFO, Steve Miller, said because of macroeconomic uncertainties “we have rationalized our expense base and adopted a new outlook on the remainder of the year. As a leadership team, we are taking a disciplined approach to manage costs to set us up for sustainable growth and profitability.”

Cost-control initiatives of Warby Parker, including lowering marketing expenses and a reduction in its workforce by 15%, will yield savings within the $8-$9 million range in 2022. Also, the company expects cost benefits of $15-$18 million in 2023.

Is WRBY Stock a Good Buy Now?

At current levels, Warby Parker could be a good buy for long-term investors. Patience is imperative before the impact of the company’s corporate restructuring and cost-control initiatives are fully reflected in its financial performance. Also, a large addressable eyewear market in the United States, estimated to be worth $44 billion, mirrors growth opportunities for the company.

For short-term investors, a wait-and-watch approach could be an ideal choice.

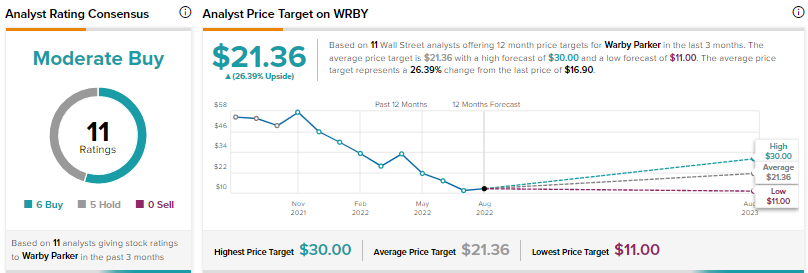

On TipRanks, analysts are cautiously optimistic on WRBY, which commands a Moderate Buy consensus rating based on six Buys and five Holds. WRBY’s average price forecast is $21.36, suggesting 26.39% upside potential from the current level.

Read full Disclosure