Walt Disney (NYSE:DIS) is set to report a $1.5 billion impairment charge as it implements its strategy to streamline content on its streaming platforms. As part of a cost-cutting initiative, Disney canceled several shows and movies, removing them from its platforms in the final week of May.

It is important to note that the company is actively reviewing the content on its platforms, which may result in further removals this month. This move is expected to result in an additional expense of approximately $400 million for DIS.

Furthermore, Disney may have to pay contract termination fees and cash payments as it moves forward with the cancelation of specific license agreements. These expenses will be reflected in the company’s fiscal third-quarter results, which are anticipated to be released on August 8.

It is important to highlight that Disney’s efforts to minimize losses in its streaming division have yielded positive results. In its fiscal second-quarter results, announced on May 10, DIS reported an operating income of $1.12 billion for its Disney Media and Entertainment Distribution unit. This compares favorably with an operating loss of $10 million in the previous quarter.

Today, Morgan Stanley analyst Benjamin Swinburne reiterated a Buy rating on DIS stock stating that its media business is undervalued. Furthermore, Swinburne suggests that the Media segment is currently underperforming in terms of earnings potential.

Is Disney Stock a Buy or a Hold?

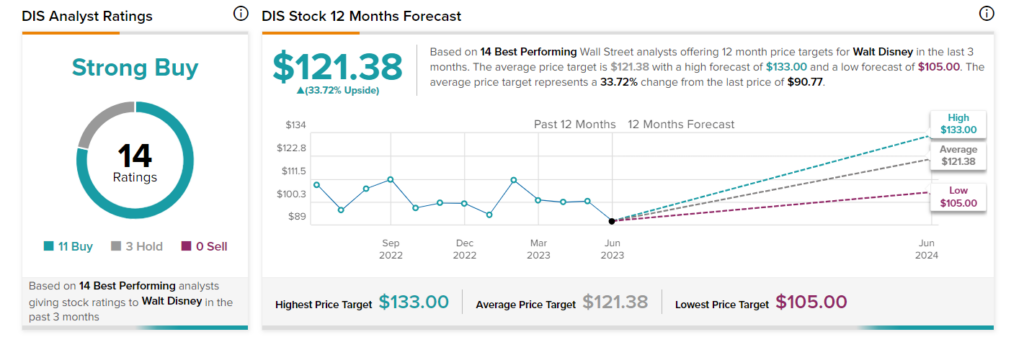

Among the 14 top Wall Street analysts giving ratings on DIS stock, 11 recommend a Buy and three suggest a Hold, resulting in a Strong Buy consensus rating. Further, the consensus 12-month price target of all top analysts of $121.38 implies an upside potential of 33.7%.

It is noteworthy that these top analysts have an impressive history of helping investors generate massive returns from their recommendations. Moreover, each analyst has a remarkable success rate.