Entertainment and media company Walt Disney (NYSE:DIS) is mulling options for its Star India business, which include the possibility of forming a joint venture or pursuing a sale. According to The Wall Street Journal’s report, DIS has held discussions with banks to explore potential strategies for expanding the Indian business by sharing costs.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Disney’s decision to consider options is influenced by recent challenges. This year, Disney faced a setback when it lost the streaming rights for the latest season of the Indian Premier Cricket League. As a result, DIS is expected to witness a loss of 8 million to 10 million subscribers to its Disney+ Hotstar streaming service in the fiscal third quarter.

The loss of broadcast rights is also expected to have financial implications for the company. Star’s revenue for Fiscal Year 2023 is expected to fall by 20% year-over-year to less than $2 billion.

Brief Background of DIS and Star India

In 2019, The Walt Disney Company acquired Star India as part of its larger acquisition of 21st Century Fox for $71.3 billion. At the time of the deal, Star India held immense significance for Disney, as it played a vital role in Disney’s strategy of expanding its streaming business on a global scale.

With the acquisition of Star India, Disney gained access to a wide range of television channels in various languages. This helped expand its broadcasting capabilities and allowed the company to cater to diverse audiences in India. Additionally, the acquisition provided Disney with a stake in a prominent Bollywood movie production company.

What is the Price Target for DIS?

Prior to the release of Disney’s fiscal third-quarter earnings scheduled for August 9, Rosenblatt Securities analyst Barton Crockett reiterated a Buy rating on DIS stock but lowered the price target to $111 from $118.

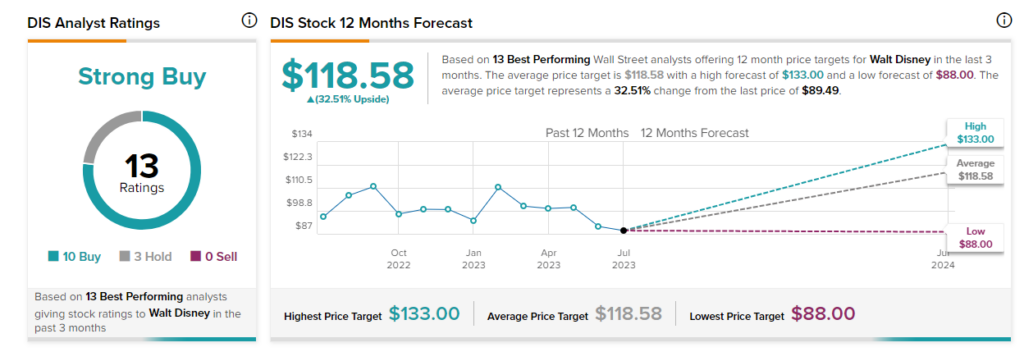

Among the 13 top Wall Street analysts giving ratings on DIS stock, 10 recommend a Buy, and three suggest a Hold, resulting in a Strong Buy consensus rating. Further, the consensus 12-month price target of all top analysts of $118.58 implies an upside potential of 33.7%.

It is noteworthy that these top analysts have an impressive history of helping investors generate massive returns from their recommendations. Moreover, each analyst has a remarkable success rate.