Walmart Inc. is embarking on a hiring spree. The world’s biggest retailer is seeking to recruit 20,000 workers ahead of the US holiday season as the chain prepares for a surge in online shopping amid the coronavirus pandemic.

Walmart (WMT) said it will hire more than 20,000 seasonal workers at its e-commerce fulfillment centers across the country. The retail giant is looking to fill positions, including order fillers and power equipment operators. Seasonal employees will begin immediately upon hiring and continue through Jan. 1, 2021. Walmart may turn some of these workers into regular employmees, the company said.

The hiring bonanza marks Walmart’s first seasonal recruitment spree since 2017. Meanwhile, since the outbreak of the coronavirus pandemic in March, the retail chain has already hired 500,000 workers across its stores and supply chain.

“The holidays are always a special time, and this year we think the season will mean even more to our customers. As more of them turn to online shopping, we want to ensure we’re staffed and ready to help deliver that special gift to their loved ones while continuing to fulfill our customer’s everyday needs,” said Walmart’s Greg Smith. “We’re also proud to be able to continue to provide employment opportunities across the country when it’s needed most.”

To meet the expected rise in shopping demand, Walmart has increased inventory in electronics, with a focus on TVs, laptops and video games. The retail giant will have over 1,300 new toys, including puzzles, games and Legos, and more than 800 Walmart-exclusives this holiday season. In addition Walmart is increasing availability of popular kitchen appliances, like the KitchenAid Plus Stand Mixer.

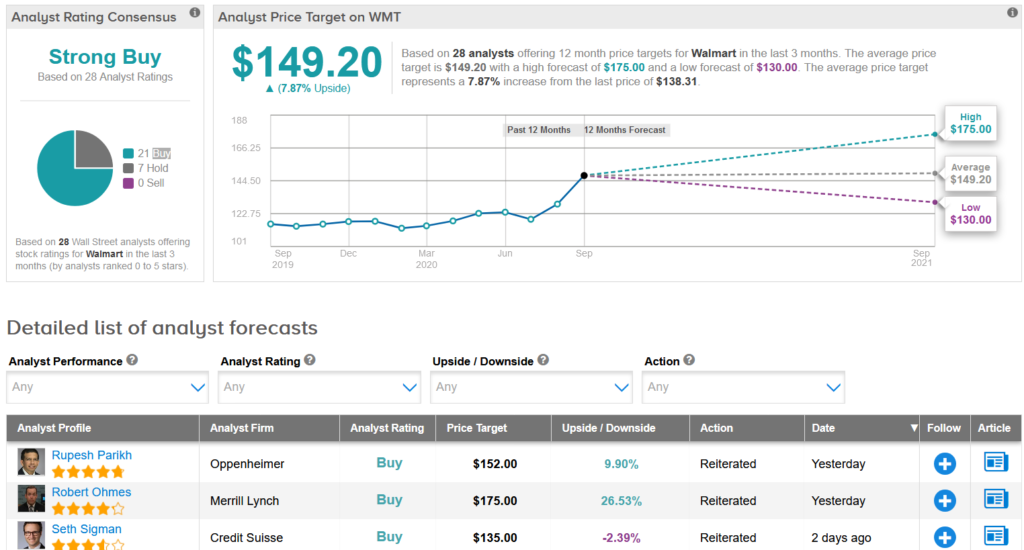

Shares in Walmart have been going from strength to strength since hitting a low in March and are now trading 16% higher than at the start of the year. What’s more, the $149.20 average price target implies 7.9% upside potential over the coming year.

Oppenheimer analyst Rupesh Parikh on Tuesday raised the stock’s price target to $152 (9.9% upside potential) from $145 and maintained a Buy rating, saying that the bull case remains intact with further upside potential amid expectations for continued aggressive investments within the business.

“We still see the case for outperformance driven by the potential to deliver at least LSD operating income growth and upside potential related to new investments,” Parikh wrote in a note to investors. “In coming years, we expect WMT to be one of the bigger beneficiaries related to retail dislocations in the brick & mortar landscape due in large part to the continued omni-channel investments.”

Commenting on the stock’s valuation, the analyst noted that on a relative P/E basis, WMT shares trade at 1.18x below recent peaks. “Similar to other higher performing companies in our universe, shares trade at historical peaks on absolute NTM P/E and EV/EBITDA. These metrics do not capture successful digital investments to date such as JD.com and Flipkart,” he added.

The rest of the Street is in line with Parikh’s bullish stance. The Strong Buy analyst consensus boasts 21 Buy ratings versus 7 Hold ratings. (See Walmart’s stock analysis on TipRanks).

Related News:

Ralph Lauren To Cut 15% Of Workforce In Online Shift; Shares Rise 5.4%

Shopify Reveals Rogue Team Members Stole Merchant Data

Walmart Partners With Goldman To Offer Marketplace Sellers Credit