Walmart (NYSE: WMT) has posted upbeat fourth-quarter Fiscal Year 2022 (ended January 31) results driven by strong consumer demand. The U.S. multinational retail company expects sales, operating income and earnings to increase this year, with expectations of subsiding COVID-19 related costs and disruptions in the supply chain challenges.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Walmart’s CFO Brett Biggs commented, “Supply chain costs were over $400 million higher than expected, but we expect some of those costs to abate overtime.”

Following the results, shares of the company rose 4% to close at $138.88 on Thursday.

Results in Detail

Walmart reported adjusted earnings of $1.53 per share, beating analysts’ estimates of $1.50 per share. The company had recorded adjusted earnings of $1.39 per share in the same quarter last year.

Total revenue for the quarter came in at $152.9 billion, up 0.5% year-over-year, and topped analysts’ expectations of $151.5 billion. Revenues were negatively impacted by $10.2 billion due to divestitures.

Walmart U.S. comp sales surged 5.6% to $105.3 billion in the quarter on the back of record holiday sales, including U.S. e-commerce sales growth of 1%. Markedly, the segment had its first-ever over $100 billion sales.

Additionally, Sam’s club net sales were $19.2 billion, up 16.5%. Meanwhile, International net sales came in at $27 billion, down 22.6% year-over-year, impacted by divestitures. Notably, strong growth was recorded in China, Mexico and Flipkart.

Adjusted operating income came in at $6 billion, up 6.2% year-over-year. Gross margin was 23.8%, up 10 basis points.

For Fiscal 2022, Walmart reported total revenue of $572.8 billion, up 2.4% year-over-year, including the impact of divestitures. Adjusted earnings stood at $6.46 per share, up from $5.48 reported last year.

Official Comments

Walmart CEO Doug McMillon said, “We had another strong quarter to finish off a strong year. We have momentum in our business in all three segments. We’re being aggressive with our plans and executing on the strategy. It’s exciting to see how the teams are simultaneously navigating today’s challenges and reshaping our business.”

Guidance

For Fiscal 2023, excluding divestitures, the company expects total net sales to grow around 4%. Total operating income is projected to increase at a rate higher than net sales, while EPS is anticipated to increase 5% to 6%.

Due to continued investments in strategic priorities, Capital Expenditures are expected to be at the upper end of the guidance of 2.5% to 3% of sales.

Capital Deployment

During the Fiscal Year 2022, Walmart repurchased shares worth $9.8 billion and returned a total of $16 billion to shareholders, including dividends.

Concurrent with the earnings release, the company announced a hike in its annual dividend by almost 2% to $2.24 per share, reflecting a quarterly dividend of $0.56 per share. This marks the company’s 49th consecutive year of dividend increases. The company’s annual dividend now reflects a dividend yield of 1.61%.

The new quarterly dividend will be paid on April 4, 2022, to shareholders of record as of March 18.

Wall Street’s Take

Following the results, Goldman Sachs analyst Kate McShane reiterated a Buy rating on Walmart with a price target of $175 (26.01% upside potential).

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 13 Buys and 6 Holds. The average Walmart price target of $163.72 implies 17.89% upside potential to current levels. Shares have lost 1.6% over the past year.

Website Traffic

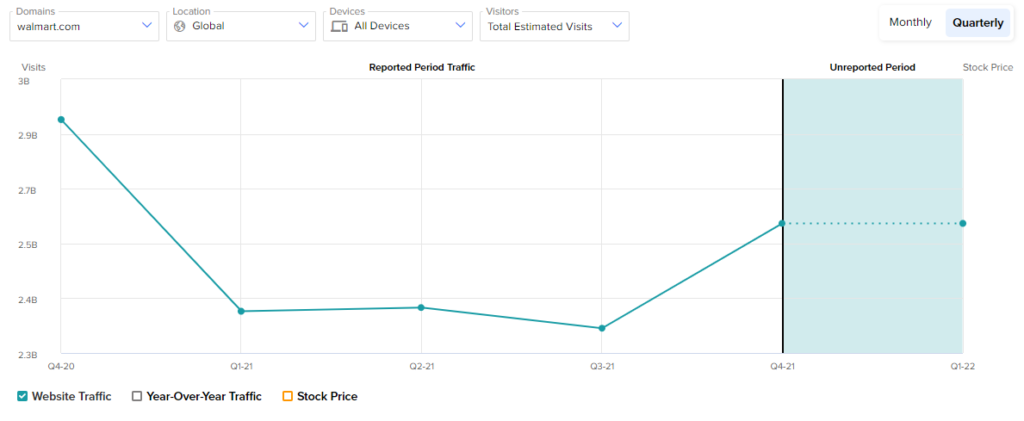

The earnings results were evident on TipRanks’ new tool that measures visits to Walmart’s website. Pre-earnings, we were able to get insights into Walmart’s performance in the fiscal fourth quarter.

According to the tool, a website traffic uptrend was visible. In the fourth quarter of Fiscal 2022, total estimated visits on walmart.com showed an increasing trend, on a global basis, representing a 12.39% jump from the third quarter. This, in turn, indicated that the company might report strong revenues in the reported quarter.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Cisco Posts Upbeat Q2 Results; Shares Rise After-Hours

Spotify Buys Podsights and Chartable

Matterport Books Wider-than-Expected Q4 Loss; Shares Drop Pre-Market