Retail giant Walmart Inc. reported better-than-expected 3Q earnings of $1.34 per share, surpassing analysts’ estimates of $1.18 and were up from the prior-year earnings of $1.16. Revenues of $134.7 billion grew 5.2% year-over-year and exceeded the Street’s estimates of $132.2 billion, driven by a surge in online demand amid the coronavirus pandemic. Despite upbeat results, Walmart shares closed 2.2% lower on Tuesday.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Walmart’s (WMT) 3Q U.S. sales grew 6.2%, while international sales increased 1.3% and Sam’s Club sales rose 8.3% year-on-year. The company’s U.S. e-commerce sales spiked 79% year-over-year and contributed approximately 570 basis points to comparable store sales (comps).

U.S. comps in 3Q increased 6.4% versus 3.2% in the year-ago quarter, driven by strong performance in key businesses, including general merchandise, health & wellness and food. Sam’s Club comps rose to 11.1% from just 0.6% in the year-ago quarter. (See WMT stock analysis on TipRanks)

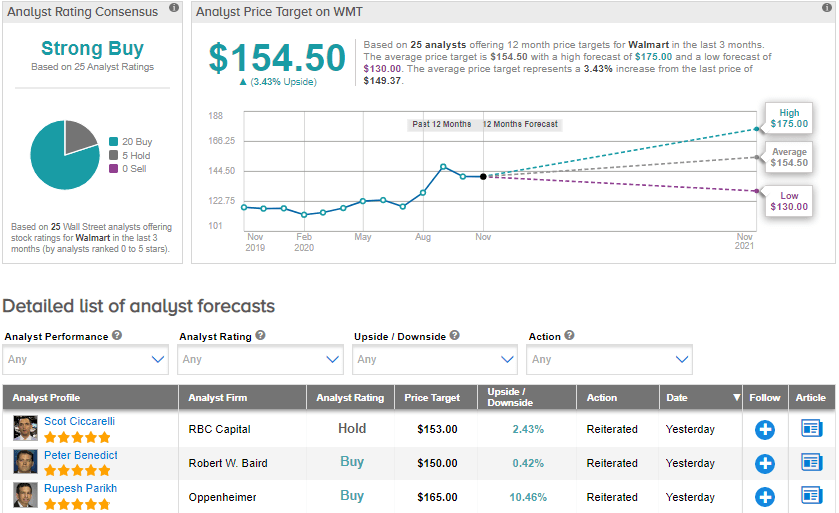

Following the earnings results, Oppenheimer analyst Rupesh Parikh raised the stock’s price target to $165 (10.5% upside potential) from $152 and maintained a Buy rating. The analyst believes “WMT shares are still positioned for outperformance, but see more of a grind higher from here. Ongoing benefits from WMT’s e-commerce investments, tailwinds from continued increases in at-home food consumption, and retailer liquidations suggest the potential for market share gains to persist.” Parikh also looks favorably upon “the strong underlying cash generation, and the potential for more aggressive return of capital to shareholders in coming years.”

Like Parikh, the Street also has a bullish outlook on the stock. The Strong Buy analyst consensus is based on 20 Buys and 5 Holds. The average price target stands at $154.50 implying upside potential of about 3.4% to current levels. Shares have risen by about 25.7% year-to-date.

Related News:

Walmart To Sell 85% Stake In Japan’s Seiyu; Street Bullish

JD.com Surprises With 3Q Profit; Street Sticks To Buy

Baidu Surprises With 3Q Sales Driven By China Recovery; Street Bullish