Retailers throughout the ecosystem are frantically wondering what the consumer will look like in 2024. Will they be as resilient as they were in 2023? Or will their fears overtake them, cause them to tighten their belts, and, in turn, leave the retailer out in the cold? The answer, so far, isn’t looking good, as Walmart (NYSE:WMT) CEO Doug McMillon noted in a recent interview. That interview hit Walmart stock, sending shares down fractionally in Wednesday afternoon’s trading.

McMillon took a look at the overall landscape and ultimately said that the retail situation in 2024 is hard to predict. Given the current conditions on the ground—with credit card use climbing, excess savings all but tapped out, and inflation still running wild—a prediction might be easier to make than McMillon asserts.

But most CEOs don’t come right out and announce that their employees should start looking for new jobs immediately because their entire sector is heading for calamity. While certainly, there are some improvements—toy prices are coming down, for example—they may not be enough to get consumers fired up.

Walmart Tries to Fire Up the Consumer

So if prices can’t do the job, what will? Walmart has at least one plan in mind: a “shoppable series.” Yes, Walmart commissioned an entire romantic comedy series called “Add to Heart,” which featured over 330 products that viewers could order while watching the 23-part series. The series will be available on a range of platforms, from TikTok to Roku (NASDAQ:ROKU).

The only question, of course, will be if anyone’s willing to open their wallet just because they saw somebody use the product in the middle of a holiday movie storyline. Further, Walmart also recently added breast cancer screening services to its lineup in conjunction with RadNet (NASDAQ:RDNT), which will hopefully get more potential shoppers in the door.

Is Walmart a Good Stock to Invest in Right Now?

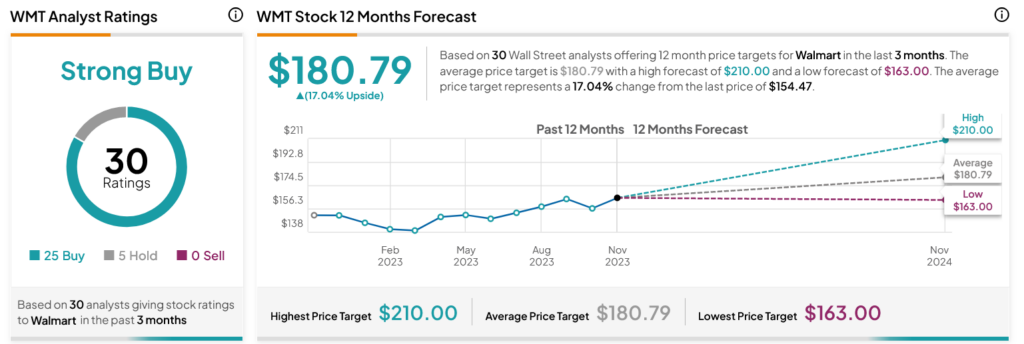

Turning to Wall Street, analysts have a Strong Buy consensus rating on WMT stock based on 25 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 4.9% rally in its share price over the past year, the average WMT price target of $180.79 per share implies 17.04% upside potential.