China loves a bargain. If you’ve ever seen prices on Chinese websites like Temu or Alibaba (NASDAQ:BABA), then you know they feature some pretty spectacular prices. While the old sayings about buyers being wary still apply, the prices are still impressive. And, in a bit of a turnaround, both retail giants Walmart (NYSE:WMT) and Costco (NASDAQ:COST) are increasingly welcome in China.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

It isn’t so much Walmart that China seems fond of right now, but rather Sam’s Club, the bulk-purchase imprint of Walmart that serves much the same function as Costco does in the market. But the Chinese appear to be particularly enamored with bulk buying right now, as floods of shoppers hit the opening day of Costco’s latest store in Shenzhen, in southern China. One shopper even noted that what he picked up at Costco would have cost twice that had he shopped in Hong Kong.

They came in search of a range of prizes, from food to the Lotso Huggin bear from Disney/Pixar’s “Toy Story 3.” It’s actually the sixth store that Costco opened in China, and the latest store opening was apparently greeted with such fervor that local officials had to turn to crowd-control measures to keep the peace.

Many Costco Shoppers Stocked Up on Food

While the crowds were brisk at the opening of the new Costco, reports suggest that maybe the crowds aren’t as big as some might think. A report from the South China Morning Post noted that overall crowds at Costco were dropping, though there were still plenty of shoppers in line. Moreover, what those customers were buying was also worth noting: many showed up for inexpensive luggage but were also stocking up on food. The report noted that “cut-price foodstuffs” were tops on Shenzhen Costco buyers’ lists.

Is Walmart or Costco the Better Buy?

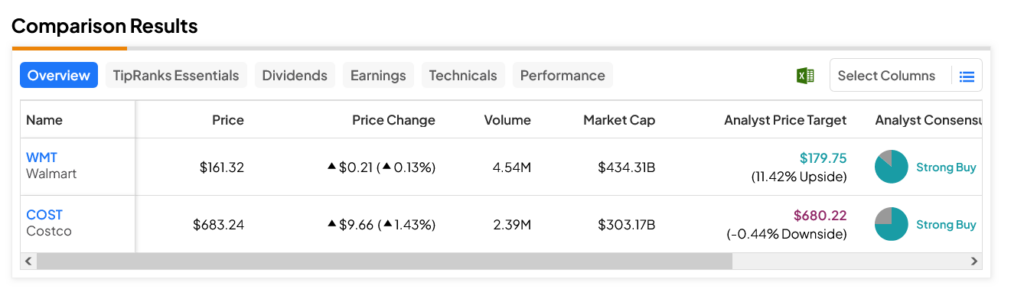

Turning to Wall Street, analysts consider both Costco and Walmart stocks as Strong Buys right now. However, WMT stock has the strongest upside potential, as its average price target of $179.75 gives its shares an 11.42% upside potential. Meanwhile, COST stock comes with a 0.44% downside risk thanks to its average price target of $680.22 per share.