American multinational retailer Walmart, Inc. (WMT) has hiked the truckers’ salaries by announcing that a first-year truck driver could earn as much as $110,000.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shares of Walmart closed up a little over 1% at $156.54 on April 7, after hitting a fresh all year high of $157.54 following multiple news items, including its Indian unit Flipkart’s increased IPO valuation target and truckers’ pay hike.

Year-to-date, WMT stock is up 8.6% and has gained 13.8% over the past year. All these steps are directed toward retaining current drivers and attracting new drivers to its private truck fleet. Since the onset of the pandemic, the labor market has witnessed a supply crunch. Moreover, persistent supply chain issues and increasing freight costs have impacted company performance throughout the retail industry.

Incentivizing Truck Drivers

Walmart has an approximately 12,000 driver fleet currently and claims to be one of the best companies to drive for. The $110,000 salary for year one is just the base, and drivers with more experience and location can earn even higher pay.

According to Glassdoor, in 2021, a long-haul driver’s average salary was about $56,491 yearly. Walmart’s latest price increase is almost double that amount and comes with a host of other benefits like the Live Better U program, which pays for employees’ tuition fees and books for a college degree.

Moreover, Walmart also launched a Walmart Private Fleet Development Program, a 12-week program under which supply chain associates can earn a commercial driver’s license and become full-time private fleet Walmart drivers.

“The investments in pay and training build on multiple recent driver bonuses and improved schedules that enable drivers to spend more time at home. There’s never been a better time to join our fleet. Once drivers are on board, this is a job many leave only for retirement,” the company stated on disclosing the news.

Analysts’ Take

Recently, Jefferies analyst Stephanie Wissink issued an ESG and U.S. Consumer Report under which she studied the ESG effects in their sector.

In regards to Walmart being one of the world’s largest retailers, the analyst believes the company has the power “to influence and make ESG-related change affordable and desirable for others in the industry through its investments, partnerships, and scale.”

Additionally, the analyst is encouraged by the pay hikes introduced by WMT for its 1.7 million associates, as well as the company’s plan of a zero-emission fleet and operations globally by 2040.

Wissink has a Buy rating on the WMT stock with a price target of $175, which implies 11.8% upside potential to current levels.

The other analysts on the Street have a Moderate Buy consensus rating on the stock based on 17 Buys and seven Holds. The average Walmart price target of $164.35 implies almost 5% upside potential to current levels.

Website Traffic

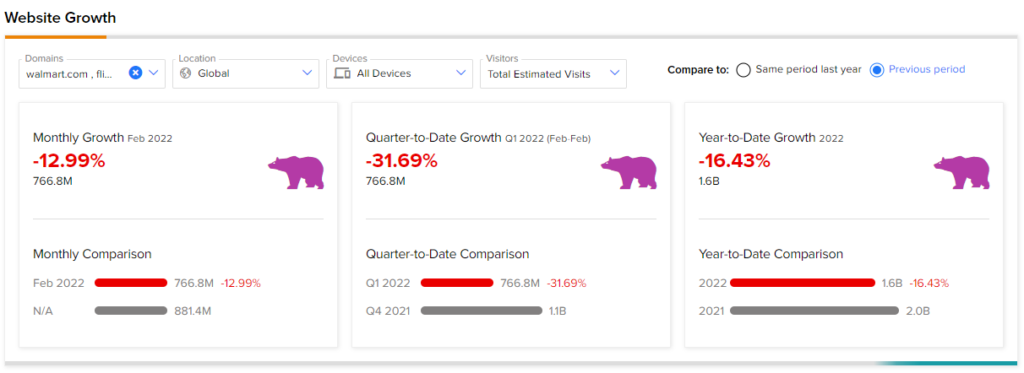

On the other hand, the TipRanks Website Traffic tool shows that in February, Walmart website traffic recorded a 12.99% year-over-year decrease in monthly visits. Similarly, year-to-date website traffic growth decreased by 16.43% compared to the same period last year.

This indicates that in the unreported quarter, Walmart is likely to report weaker numbers compared to prior quarters. Walmart is scheduled to report its first-quarter fiscal 2022 results on May 17, 2022.

Moreover, on the valuation front, WMT stock is currently trading above both its industry average as well as the five-year average multiple of price/earnings (non-GAAP), making it a pricey bet. Considering the stock hit a new all-time high yesterday, it would be advisable to hold on to the stock for a while until performance indicators improve, or wait until the shares trade a bit lower and reflect a good entry point.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Bed Bath & Beyond Boards Kroger’s Ship

Levi Strauss Rises on Upbeat Q1 Results

Toyota to Develop Cheap Self-Driving Cars