Just like the previous two years, Alibaba’s (NYSE:BABA) 2023 offered mostly disappointment on the stock market front. To wit, the shares are currently down by 36% from the same time a year ago.

However, looking at the Chinese tech giant’s prospects, Jefferies analyst Thomas Chong is confident BABA still has plenty to offer investors.

“We expect BABA to drive AI innovation and unlock synergies across TTG (Taobao Tmall Group), and Cloud,” the analyst said. “We view BABA’s strategies as intact after announcing 3-year goals and it continues to return value to shareholders.”

That value might be less tangible considering the lack of recent returns, but the company has been busy restructuring the business, and moving forward, Chong expects the changes to yield results.

One of the big changes involves the appointment of Alibaba Group CEO Eddie Wu as the CEO of TTG, the company’s largest revenue generator, replacing Trudy Dai, who will be involved in establishing an asset management company. “We expect the company to focus on management of non-core assets in order to increase return of capital to shareholders,” Chong opined on the matter. “We believe these moves could further unlock synergies after the 3-year goals are set for different business units.”

Looking ahead to Alibaba’s December quarter earnings, Chong is forecasting a year-over-year revenue growth rate of 5%, which is down from the previous forecast of 7%, and is expected to reach RMB260 billion. Breaking it down by segments, Chong expects that TTG revenue will increase by only 1% y/y (compared to the previous expectation of 5.5%), reaching RMB128 billion. CMR (Customer Management Revenue), on the other hand, is expected to remain flat, as opposed to the prior expectation of a 3% increase, and reach RMB91 billion. Furthermore, Chong believes GMV (gross merchandise volume) will experience a 3% year-over-year growth, an improvement over the previous estimate of 1%.

“The slower growth in CMR vs GMV is mainly due to a change in product mix, while the respective take rates for Taobao and Tmall likely increase YoY,” Chong explained.

Better growth than previously anticipated should be on the menu for Alibaba International Digital Commerce Group (AIDC). Revenue is now expected to rise by 41% y/y vs. 29% previously with Chong commenting that there was “better-than-expected revenue momentum and adoption of entrusted model for AIDC’s cross-border segment.”

All in all, Chong rates BABA shares a Buy, although he lowers his price target from $145 to $133. Nevertheless, the revised figure still factors in ample upside of ~84% from current levels. (To watch Chong’s track record, click here)

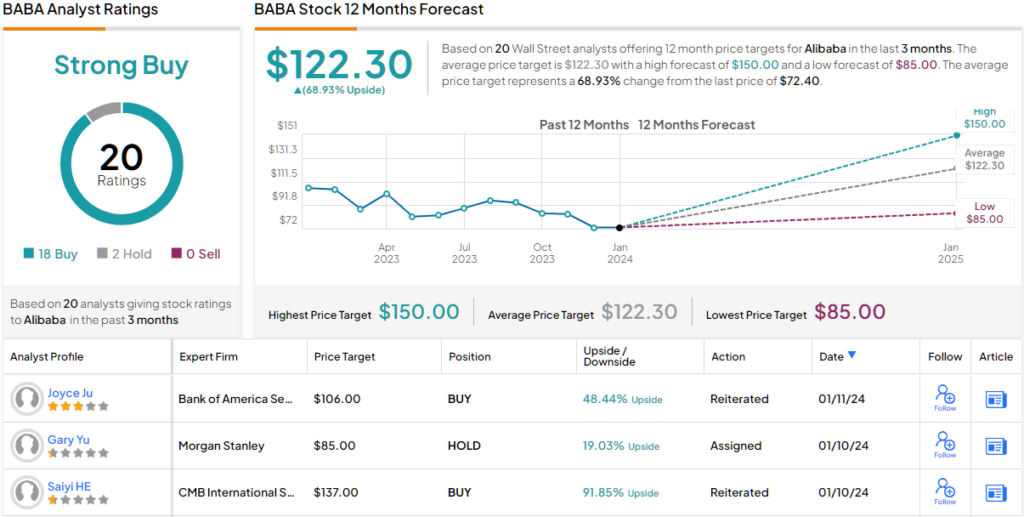

Most analysts are thinking along the same lines. BABA stock claims a Strong Buy consensus rating based on a mix of 18 Buys and 2 Holds. Going by the $122.30 average target, a year from now, investors will be sitting on returns of ~69%. (See Alibaba stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.