Wall Street remains skeptical about Tesla’s (TSLA) ability to avoid its first annual sales decline in over a decade, even as enthusiasm builds around Donald Trump’s upcoming presidency. Analysts estimate that the EV maker could deliver around 510,400 vehicles in Q4, which would set a new quarterly record but falls short of the 515,000 needed to meet its 2024 growth forecast. As a result, investors will be watching closely as the company reports production and delivery figures on January 2.

Don't Miss Our New Year's Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Despite adding over $733 billion in market value since Election Day due to Elon Musk’s collaboration with Trump, Tesla still faces potential hurdles. While a federal framework for autonomous vehicles is promising, repealing EV subsidies and rolling back emissions regulations could hit Tesla’s bottom line. In addition, analyst Gene Munster noted that Tesla’s shift toward Trump supporters may alienate its traditional consumer base, though expiring tax credits could drive a short-term sales surge.

It also does not help that Tesla has lost momentum amid a global slowdown in EV sales, with rivals like BYD gaining ground through plug-in hybrids and automakers like Volkswagen scaling back their EV goals. Nevertheless, Elon Musk remains optimistic about 2025 and forecasts 20%-30% sales growth, partly thanks to affordable new models that are expected next year. However, analysts caution that headwinds like lower oil prices and a stronger dollar could limit Tesla’s growth to 10%-15% – far below its ambitious targets.

Is Tesla Stock a Buy, Hold, or Sell?

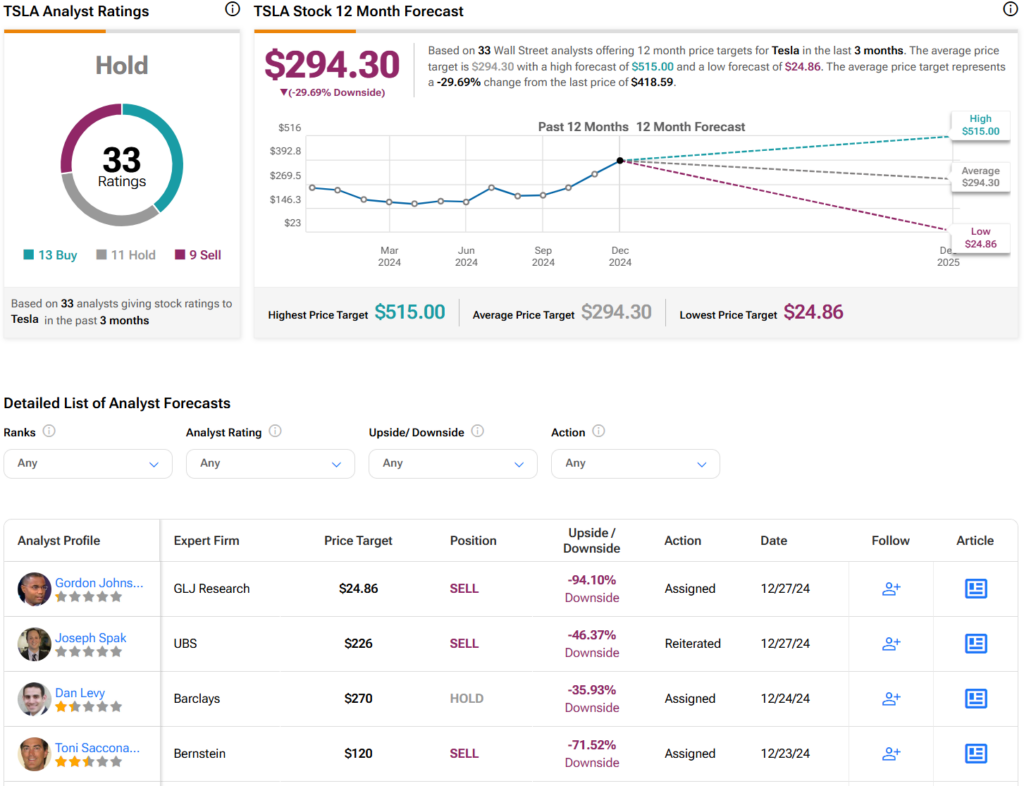

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 13 Buys, 11 Holds, and nine Sells assigned in the past three months, as indicated by the graphic below. After a 68% rally in its share price over the past year, the average Tesla price target of $294.30 per share implies 29.7% downside risk.