The Trade Desk (TTD) recently reported strong Q3 earnings and Wall Street is pounding the table on it. While shares of the digital advertising and marketing automation company have dipped today, multiple analysts have increased their price targets as The Trade Desk enters its final quarter of 2024. This suggests that TTD stock will enjoy a strong end to the year and enter 2025 poised for further growth.

What’s Happening with The Trade Desk Stock

Despite a strong earnings report, The Trade Desk stock is faltering today and is poised to close out trading in the red. As of this writing, it is down 6% for the day after rising steadily after markets opened. This can likely be attributed to general negative market momentum, which means trading should stabilize next week. TTD stock has still performed well over the past three months and is currently up 26% for the quarter.

Even with today’s decline, Wall Street isn’t too concerned with The Trade Desk’s growth prospect. Multiple analysts have issued bullish takes since the Q3 earnings report came out, predicting notable share price growth. Let’s take a look at the new price targets and ratings.

- Both Jason Helfstein of Oppenheimer and Youssef Squali of Truist Financial raised their TTD stock price targets from $120 to $135 while maintaining Buy ratings. These predictions imply an upside potential of 8%.

- Shyam Patil of Susquehanna raised their price target from $135 to $150, also maintaining a Buy rating. This prediction implies a 20% upside potential.

- Chris Kuntarich of UBS (UBS) raised his price target from $140 to $150, also implying an upside potential of 20%. Like the others, he maintains a Buy rating.

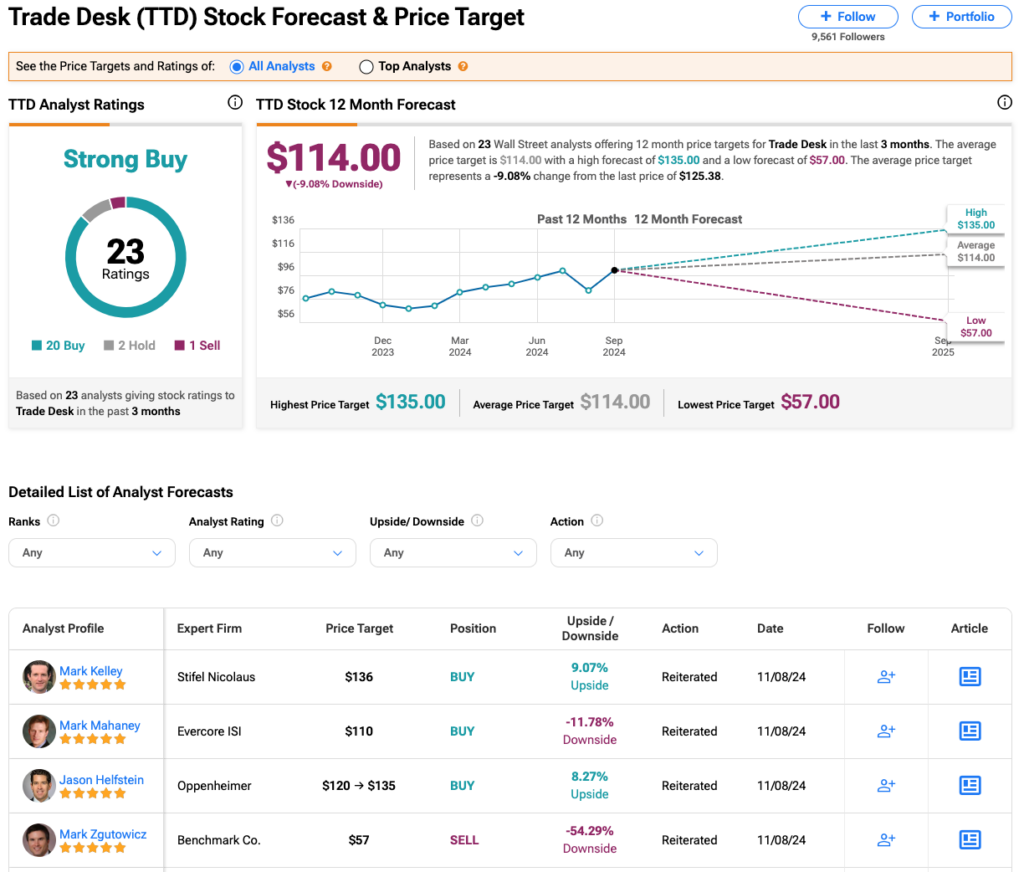

- Other analysts such as Mark Kelley of Stifel Nicolaus and Mark Mahaney of Evercore ISI have reiterated Buy ratings for TTD stock, though their price targets remain unchanged.

Is TTD Stock a Strong Buy Right Now?

Overall, analysts have a Strong Buy consensus rating on TTD stock based on 20 Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 62% rally in its share price over the past year, the average TTD price target of $114 per share still implies 9% downside potential.