Palo Alto Networks (PANW) recently announced a 2-for-1 stock split, and Wall Street is still bullish on it. Multiple analysts have increased their price targets despite the cybersecurity firm’s mixed Q3 earnings. This suggests that experts see PANW stock as a Buy ahead of the stock split, which is scheduled to take effect on December 16, 2024. This positive sentiment is likely to help shares continue trending upward over the coming weeks as this key date approaches.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

What’s Happening with Palo Alto Networks Stock?

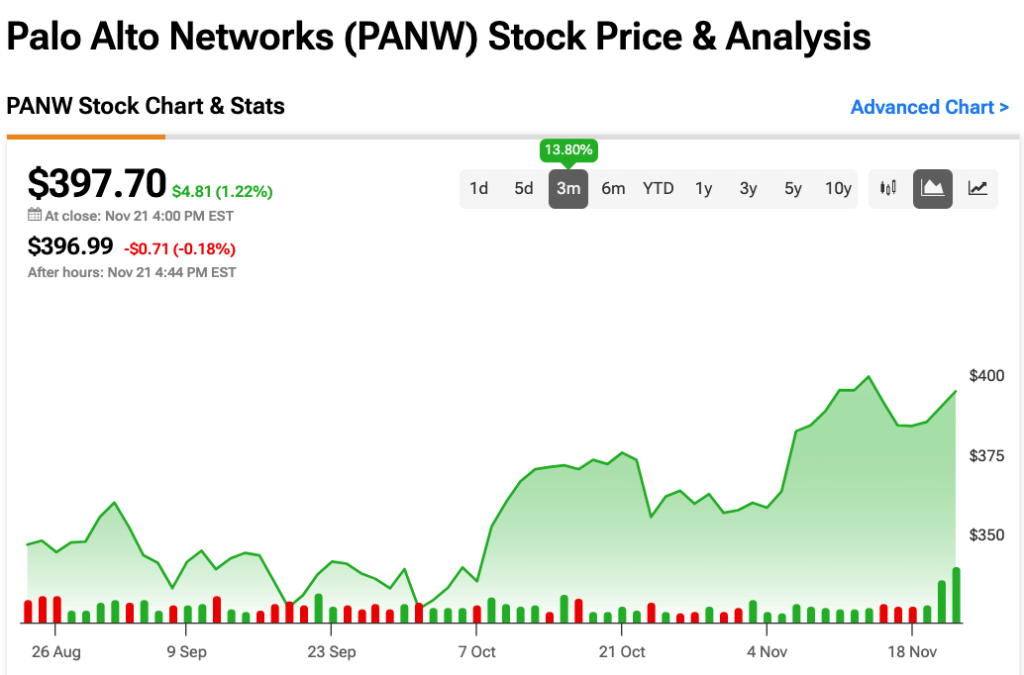

Despite falling as markets opened this morning, Palo Alto Networks stock quickly rebounded and spent most of the day rising. Shares closed out the day up 1%, although they dipped again during after-hours trading. While the past week has been volatile, PANW has managed to stay mostly in the green and has made encouraging progress over the past three months, with gains of 14% for the quarter.

Since the company announced the stock split, analysts have rushed to increase their price targets. While Rob Owens of Piper Sandler maintains a Hold rating, he still increased his PANW price target from $330 to $385 and noted some encouraging elements reflected in the Q3 earnings report, such as growth in “both top- and bottom-line metrics.”

Meanwhile, Keith Bachman of BMO Capital increased his price target from $390 to $425 per share, implying 7% upside potential. Brad Zelnick of Deutsche Bank isn’t quite as bullish on PANW but he still increased his price target from $395 to $415, implying 4% upside potential. Both he and Bachman reiterated Buy ratings for Palo Alto Networks.

Wall Street Remains Highly Bullish on PANW Stock

Overall, Wall Street is optimistic about Palo Alto Network’s growth prospects. Analysts have a Strong Buy consensus rating on PANW stock based on 19 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 51% rally in its share price over the past year, the average PANW price target of $422 per share implies 6% upside potential.