Shares of Walgreens Boots Alliance closed 3.6% higher on Wednesday after the drugstore operator reported better-than-expected 2Q profits. Meanwhile, the company raised its earnings guidance for fiscal 2021.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Walgreens’ (WBA) 2Q adjusted earnings of $1.40 per share declined 7.5% year-over-year but topped the Street’s estimates of $1.11 per share. On a constant currency basis, adjusted EPS declined 8.2% due to lower operating income amid the COVID-19 pandemic.

Sales increased 4.6% year-over-year to $32.8 billion, reflecting strong growth in the United States segment. Meanwhile, the International segment benefitted from its joint venture in Germany. Analysts were expecting 2Q sales of $35.5 billion.

As for fiscal 2021, the company raised its adjusted profit growth guidance to the mid to high-single-digit range in constant currency terms. It had previously projected adjusted profits to increase by a low-single-digit range. Analysts expect FY21 EPS of $4.89 per share. The company said that it expects strong growth in the second half of the current fiscal year. (See Walgreens Boots Alliance stock analysis on TipRanks)

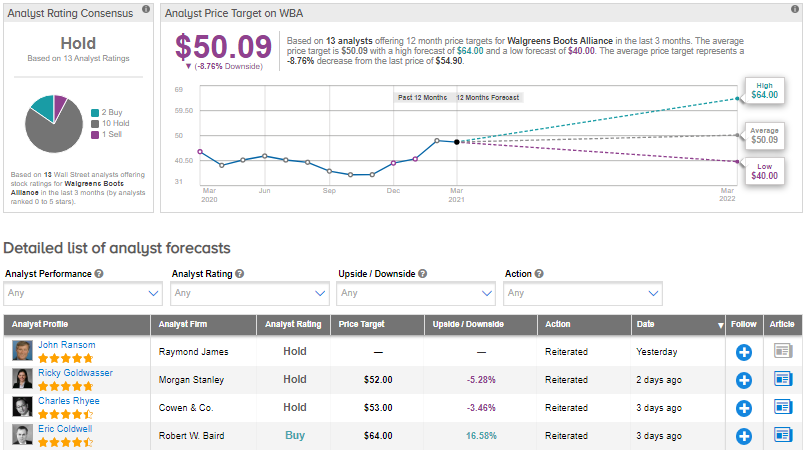

Following the results, Raymond James analyst John Ransom maintained a Hold rating on the stock. In a note to investors, the analyst said that the 2Q results were “better than feared, but raised outlook doesn’t paint overly optimistic F2H.”

Meanwhile, the Street has a Hold consensus rating on the stock based on 10 Holds, 2 Buys and 1 Sell. The average analyst price target of $50.09 implies downside potential of about 8.8% to current levels. Shares have gained over 27% in one year.

Related News:

AngioDynamics Gains 8% After A Blowout 3Q

FactSet’s FY21 EPS Guidance Disappoints After 2Q Miss

Lululemon’s FY21 Outlook Surpasses Estimates After 4Q Beat