Walgreens Boots Alliance has accelerated its investment in VillageMD to support the opening of 600-700 Village Medical primary care clinics at Walgreens locations in over 30 US markets within the next four years. The two companies aim to build hundreds of additional clinics thereafter.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Walgreens (WBA) disclosed that it has now completed a $750 million investment after the two companies renegotiated the terms of their agreements to ensure accelerated investment to ramp up the pace and scale of the rollout of the clinics. This brings the total investment made by Walgreens to $1 billion, including the initial equity investment of $250 million. Walgreens and VillageMD also adjusted certain other terms under the agreements.

Walgreens’ CEO Stefano Pessina stated, “Through these conveniently located clinics at our neighborhood stores, we will uniquely integrate the pharmacist as a critical member of VillageMD’s multi-disciplinary care team to provide patients with personalized and coordinated care.”

In July 2020, Walgreens and VillageMD had initially announced their agreement to open 500 to 700 clinics, under which, Walgreens would invest $1 billion (in equity and convertible debt) in VillageMD over a period of three years. (See WBA stock analysis on TipRanks)

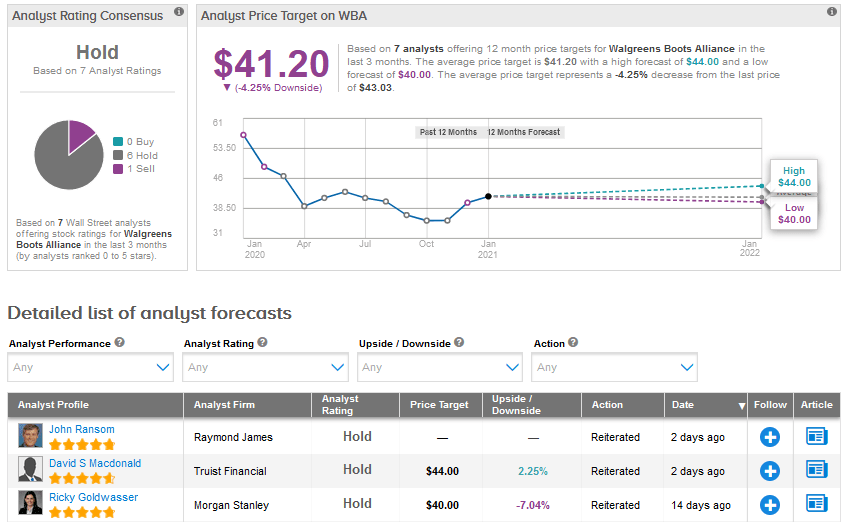

On December 24, Morgan Stanley analyst Ricky Goldwasser reiterated a Hold rating on Walgreens with a $40 price target. Ahead of the company’s fiscal first quarter results, the analyst stated that “investors will need to balance between” near-term headwinds associated with the impact of additional lockdowns in Europe and utilization patters in the US, quantifying the potential vaccine opportunity and the impact on earnings in the second half of FY21 and FY22, and to a lesser extent, the dynamics of the McKesson joint venture.

Walgreens shares have declined 28% over the past year and the average price target of $41.20 implies further downside potential of 4.3% in the year ahead. Overall, Walgreens scores the Street’s Hold analyst consensus based on 6 Holds and 1 Sell.

Related News:

Moderna’s Covid-19 Vaccine Wins EU Approval; Top Analyst Lifts PT

UnitedHealth Buys Change Healthcare; Street is Bullish

Henry Schein Snaps Up A Major Stake in Prism Medical to Enter Home Health Market