Shares of vTv Therapeutics Inc. (VTVT) rose 3.5% in the extended trading session on Monday after the clinical-stage biopharmaceutical company announced restructuring plans to prioritize its lead program TTP399 and focus its operations.

TTP399 Program

TTP399, a novel, oral, liver-selective glucokinase activator, is a potentially transformative treatment for reducing hypoglycemic episodes in type 1 diabetes patients. It has shown around 40% reduction versus placebo in its Phase 2 study, and the company is preparing for Phase 3 pivotal trials.

Markedly, the program has received Breakthrough Therapy Designation by the FDA. Additionally, in October, TTP399 demonstrated positive results from its mechanistic study, which showed no increased risk of ketoacidosis.

Type 1 Diabetes (T1D) is an autoimmune disease with no cure. It currently affects more than 1.6 million people in the United States and is expected to grow to 5 million patients by 2050. (See vTv Therapeutics stock charts on TipRanks)

Restructuring Moves

As part of its restructuring plans, vTv Therapeutics has cut its workforce by about 65%. Furthermore, it has appointed several consultants with substantial regulatory, clinical, and biostatistics experience.

Additionally, the company has put on hold its development activities on HPP737, a PDE4 inhibitor for the treatment of psoriasis.

CEO Comments

The CEO of vTv Therapeutics, Deepa Prasad, said, “It is always difficult to restructure but this allows us to focus on TTP399 and our future growth.”

“Hypoglycemia management is a serious issue impacting the lives of patients and their families. We are very excited to see TTP399’s novel mechanism of action allowing for reduction of hypoglycemic episodes with a well-tolerated safety profile. We continue to engage with the FDA to map out a clear and positive path forward on our Phase 3 pivotal studies with the goal of improving quality of life for patients managing this chronic, burdensome disease,” Prasad added.

See Top Smart Score Stocks on TipRanks >>

Wall Street’s Take

The stock has picked up a rating from one analyst in the past three months. H.C. Wainwright analyst Vernon Bernardino reiterated a Buy rating and a price target of $6 (431% upside potential) last month. Shares have fallen 45.4% over the past year.

Risk Analysis

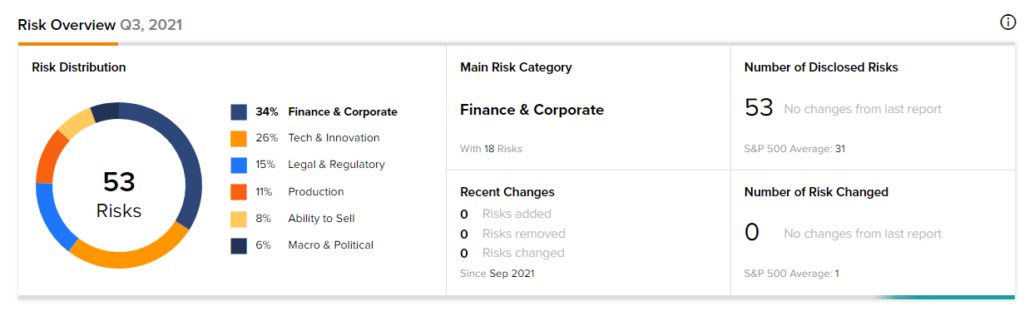

According to the new TipRanks’ Risk Factors tool, vTv Therapeutics stock is at risk mainly from three factors: Finance and Corporate, Tech and Innovation, and Legal and Regulatory, which contribute 34%, 26%, and 15%, respectively, to the total 53 risks identified for the stock.

Related News:

Amgen Bumps up Quarterly Dividend by 10%

Eli Lilly Receives Emergency Use Nod for COVID-19 Antibody Therapy in Patients Under Age 12

FDA Approves Merck’s KEYTRUDA

Questions or Comments about the article? Write to editor@tipranks.com