Shares of Vertiv Holdings (VRT) declined in pre-market trading, even as the provider of critical digital infrastructure reported better-than-expected Q3 results and raised its FY24 guidance. The company’s adjusted earnings grew by 46.2% year-over-year to $0.76 per share, surpassing consensus estimates of $0.57 per share.

Furthermore, Vertiv’s revenues surged by 19% year-over-year to $2.1 billion, above Street expectations of $1.94 billion.

Vertiv’s CEO Comments on the Results

Giordano Albertazzi, Vertiv’s CEO, commented on the results, “Vertiv’s strong performance in the third quarter was driven by robust underlying demand for our critical digital infrastructure products and services, our continued and unrelenting focus on strong operational execution, and Vertiv’s unique market position in enabling artificial intelligence and other critical applications for the data center.”

Additionally, the company was encouraged by the sales of its liquid cooling systems in the third quarter, even as the market is still developing for these systems.

Vertiv Raises FY24 Guidance

Looking ahead, the company raised its Q4 and FY24 outlook and now expects net sales in the fourth quarter to be in the range of $2.11 billion to $2.13 billion, with adjusted earnings likely to be between $0.80 and $0.84 per share. In FY24, VRT estimates revenues to be in the range of $7.78 billion and $7.83 billion, with adjusted diluted earnings forecasted to be between $2.66 and $2.70 per share.

For reference, analysts are expecting the company to report Q4 earnings of $0.75 per share on revenues of $2.16 billion. In FY24, analysts have forecasted VRT to report earnings of $2.52 per share on revenues of $7.76 billion.

Is VRT a Good Stock to Buy?

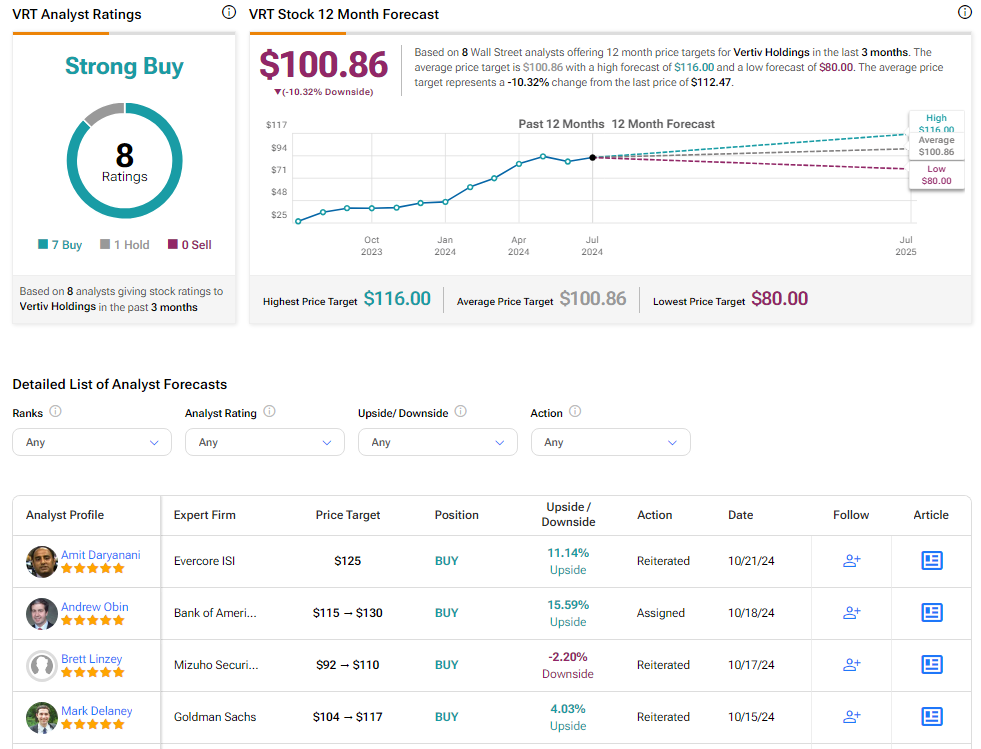

Analysts remain bullish about VRT stock, with a Strong Buy consensus rating based on seven Buys and one Hold. Over the past year, VRT has surged by more than 100%, and the average VRT price target of $100.86 implies a downside potential of 10.3% from current levels. These analyst ratings are likely to change following VRT’s results today.