Volta, Inc. (VLTA) has reported mixed results for the fourth quarter and full-year 2021. The company engages in commerce-centric EV charging networks.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

VLTA has delivered a quarterly loss of $0.77 per share, wider than the estimated loss of $0.18 per share. Volta had recorded a loss of $3.33 per share in the same quarter last year.

Revenue of $12.1 million increased 44.9% year-over-year and came in line with analysts’ estimates. The upside can be largely attributed to higher revenue within Behavior and Commerce unit, which grew to $8.6 million from $3.8 million a year ago on the back of increased sales of media campaigns with national brands.

As of December 31, 2021, the company connected 2,330 stalls, up 44% year-over-year.

Volta CFO Francois Chadwick, said, “2021 was a transformative year for both the company and the industry. We continue to see significant growth in the market, and we are well-positioned to take advantage of this acceleration.”

Guidance

For 2022, the company expects to post revenues in the range of $70 million to $80 million. VLTA expects total incremental, connected stalls between 1,700 and 2,000. Further, first-quarter revenues are expected between $8 million and $8.5 million.

Wall Street’s Take

The Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on two Buys and three Holds. VLTA’s average price forecast of $7.40 implies 165.2% upside potential to current levels.

Blogger Opinion

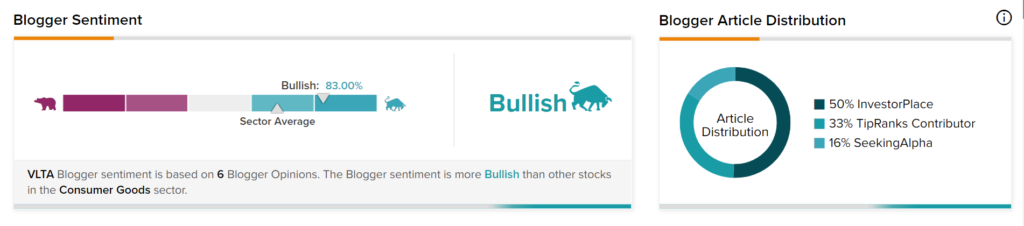

TipRanks data shows that financial blogger opinions are 83% Bullish on VLTA, compared to the sector average of 68%.

Takeaway

Volta has been able to improve its financial performance in comparison to the prior-year quarter. Further, it has continuously been making efforts to grow its business.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Why Morgan Stanley Didn’t Impress Despite Q1 Beat

CSX & Pan Am Deal Moves Past STB Hurdle

Everi Acquires XUVI’s Assets, Also Offers Crypto-to-Cash Solution