Volkswagen AG (DE:VOW) is weighing the first-ever closure of its German plants in a move to further enhance its cost-cutting efforts. The company stated that a major vehicle plant and a component factory in Germany are outdated. Additionally, Volkswagen could terminate its current agreement with unions that guarantees job security until 2029. Following the news, VOW stock gained 1.7% on Monday.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Volkswagen (VW) is a luxury car manufacturer that owns a portfolio of brands, including Volkswagen, Skoda, Audi, Bentley, Ducati, and Lamborghini.

Volkswagen Lags Cost-Cutting Targets

Amid the ongoing challenges, last year, Volkswagen’s flagship brand, VW, announced a goal to reduce costs by €10 billion and achieve an operating margin of 6.5% by 2026. However, the company stated that the savings program has fallen short of its targets. Its current strategy of providing reduced contracts and severance packages to employees nearing retirement is not enough to achieve its targets.

The company’s move to close its obsolete plants underscores the mounting pressure on European carmakers as demand for electric vehicles (EVs) slows down. These companies are facing fierce competition from Asian counterparts such as BYD Co. Limited (HK:1211) as well as U.S. giants like Tesla (TSLA).

VW Faces Potential Union Conflict

Volkswagen’s decision could spark a conflict with unions over job reductions, potentially leading to a clash with Germany’s powerful labour organizations.

Daniela Cavallo, Chairwoman of the workers’ council, has vowed to oppose the plans to close plants. Meanwhile, the IG Metall union has described the announcement as an irresponsible move that undermines the foundation of the company.

On the other hand, Oliver Blume, CEO of Volkswagen Group, believes that with a tougher economic environment and a crowded EV space, Germany’s competitiveness as a business location is waning. As a result, the company could not rule out factory closures and job cuts.

Is Volkswagen Stock a Good Buy?

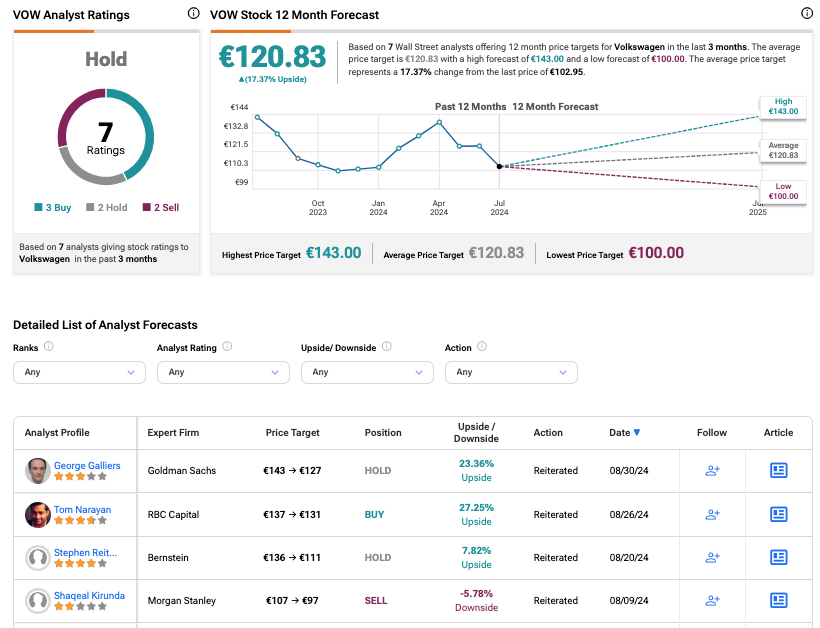

Given a challenging backdrop, analysts have a Hold consensus rating on VOW stock. According to TipRanks, VOW stock has received three Buy, two Hold, and two Sell recommendations. The Volkswagen share price forecast is €120.83, which is 17.4% above the current price level. Year-to-date, shares have lost nearly 14% of their value.