German automotive giant Volkswagen Group (DE:VOW3) has lowered its guidance for the remainder of this year as motor vehicle sales around the world continue to weaken.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The car manufacturer said that it now expects to deliver nine million vehicles worldwide this year. That’s about 3% less than the 9.24 million vehicles the company delivered in 2023. Volkswagen also said that it expects the value of its vehicle sales this year to decline by 0.7% to €320 billion (US$356.7 billion). Earlier this year, the company forecast that its sales would rise 5% year-over-year in 2024.

Lastly, Volkswagen ratcheted down expectations for its profit margin to 5.6%. Previously, management had said they anticipated a profit margin of 6.5% to 7% in 2024. This was the second time in less than three months that Volkswagen, Europe’s biggest automaker, has lowered its guidance. The company said weaker-than-expected passenger car sales are forcing it to adjust its outlook.

Global Automotive Slump

Volkswagen isn’t alone in cutting its forward guidance amid slumping sales and a gloomy outlook. Other automakers ranging from Tesla (TSLA) to Toyota Motor Corp. (TM) have downgraded their forecasts for vehicle deliveries this year amid weakening global demand, notably in China, the world’s biggest automotive market.

The lowered guidance from Volkswagen also comes as the company enters contract negotiations with IG Metall, its largest union and one of the most powerful labor groups in Europe. Earlier in September, management at Volkswagen said they are considering closing some manufacturing facilities in Germany for the first time in the company’s history as they try to achieve €10 billion (US$11 billion) in cost savings. Volkswagen currently employs 680,000 people worldwide.

Is VOW3 Stock a Buy?

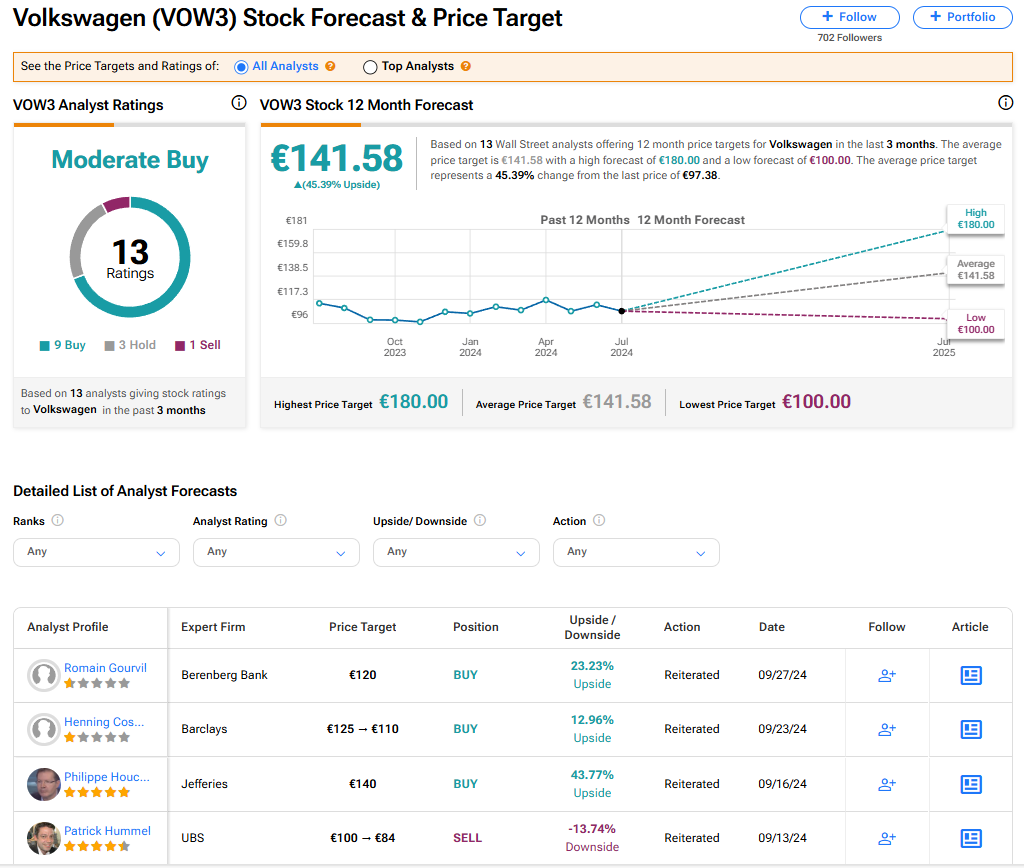

Volkswagen’s stock has a consensus Moderate Buy rating among 13 Wall Street analysts. This rating is based on nine Buy, three Hold and one Sell recommendations made in the last three months. The average price target of €141.58 (US$158.05) implies 45.39% upside potential from current levels.