VMware, Inc. (VMW), an American cloud computing and virtualization technology company, has reported upbeat results for the third quarter of Fiscal Year 2022. Strong product bookings growth in major product categories acted as a tailwind.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Results in Detail

The company reported adjusted earnings of $1.72 per share, topping the consensus estimate of $1.54 per share. VMware had reported adjusted earnings of $1.66 per share in the same quarter last year.

Total revenue of $3.19 billion grew 11% year-over-year and surpassed the Street’s estimate of $3.12 billion. Subscription and SaaS, along with license revenue, mainly drove the results.

Segment-wise, while subscription and SaaS revenues grew 21% year-over-year to $820 million, license revenue was up 11%. Additionally, services revenue surged 7.1% to $1.66 billion.

Remaining Performance Obligations (RPO) for the third quarter stood at $11.12 billion, up 9% year-over-year. (See VMware stock charts on TipRanks)

Guidance

For Fiscal Year 2022, the company expects revenue of $12.83 billion, representing year-over-year growth of 9%. Additionally, subscription & SaaS and license revenue are forecast to be $6.305 billion, reflecting a rise of 12% year-over-year. Also, adjusted earnings are projected to be $7.19 per share.

For the fourth quarter, the company projects revenue of $3.51 billion, representing year-over-year growth of 7%. Further, subscription & SaaS and license revenue are anticipated to be $1.875 billion, reflecting a rise of 9% year-over-year. Also, adjusted earnings are expected to be $1.96 per share.

CEO Comments

The CEO of VMware, Raghu Raghuram, said, “This quarter, as we unveiled many new offerings at VMworld, we showcased how we are helping customers transform their businesses today and that our innovation engine is thriving. Our mission is to be the trusted software foundation to accelerate our customers’ innovation without compromise. We are committed to helping organizations unlock the full potential of multi-cloud.”

See Insiders’ Hot Stocks on TipRanks >>

Wall Street’s Take

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 7 Buys and 7 Holds. The average VMware price target of $160.23 implies 37.56% upside potential. Shares have lost 22.6% over the past year.

Bloggers Weigh In

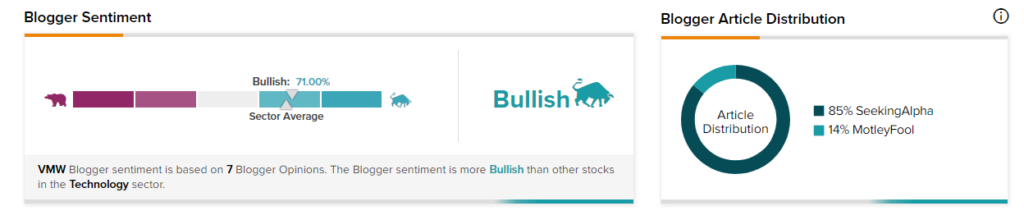

TipRanks data shows that financial blogger opinions are 71% Bullish on VMW, compared to a sector average of 69%.

Related News:

FDA Grants RMAT Designation to CRISPR’s CTX110

General Motors Acquires 25% Stake in Pure Watercraft; Shares Rise

Astra Enters Orbit; Shares Soar 17.2%