Vivint Smart Home, Inc. (VVNT) provides integrated smart home systems across North America. The company also provides in-home consultation, installation, and support services to over 1.8 million customers.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

In its recent third-quarter performance, Vivint’s revenue increased 21.2% year-over-year to $386.7 million, exceeding estimates by $27.3 million. Meanwhile, net loss per share at $0.44, missed expectations by $0.07.

Top line growth was attributed to a growing number of total subscribers, coupled with contributions from Vivint’s smart energy and smart insurance initiatives.

For Q4, analysts see the company delivering a net loss per share of $0.04 compared to the net loss of $0.91 per share for the prior-year period.

With these developments in mind, let us take a look at the changes in Vivint’s key risk factors that investors should know.

Risk Factors

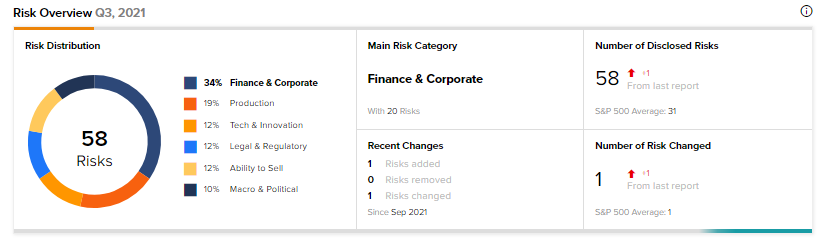

According to the TipRanks Risk Factors tool, Vivint’s top risk category is Finance & Corporate, contributing 34% to the total 58 risks identified.

In its recent quarterly report, the company has added one key risk factor under the Legal & Regulatory risk category. Compared to a sector average of 24%, Vivint’s Legal & Regulatory risk factor is at 12%.

In 2019, Vivint received a civil investigation demand from the Federal Trade Commission (FTC) regarding potential violations of the Fair Credit Reporting Act and the FTC Act. Although Vivint resolved this investigation by entering into a settlement with the FTC, the company is still in the process of administering the terms of the settlement.

Under the settlement, Vivint has to undergo biennial assessments by an independent third-party assessor, who will provide a report to the FTC on Vivint’s ongoing compliance. The risk remains that deficiencies may be identified in Vivint’s compliance efforts in the future, which may mean regulatory actions against the company. Such an event may also affect Vivint’s financials and operations.

Wall Street’s Take

Wall Street’s top analysts have a Moderate Buy Consensus rating on Vivint based on 1 Buy and 2 Holds. The average Vivint price target of $13 implies a potential upside of 85.2%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Encompass Health to Spin off Home Health and Hospice Business

U.S. Bancorp Falls 7.8% on Q4 Earnings Miss

Disney Forms International Hub to Bolster DTC Business